In the dynamic world of cryptocurrency, surprises are part of the game, and this year has brought a significant one: the unexpected strength of smaller altcoins. While the broader market anticipated Ethereum to lead the charge, the reality has been quite different, presenting an intriguing scenario for investors and enthusiasts alike.

Ethereum's Underperformance: A Shift in Market Dynamics

Ethereum, often seen as a bellwether for altcoins, is currently underperforming, causing concern among investors. Many are diverting their investments from Ethereum to alternative coins, or "alt1s," driven by fears that Ethereum might not provide the desired returns in this cycle. This trend has led to a wave of panic selling, as investors scramble to find safer havens for their assets.

The Rise of Small Caps: A New Market Trend Backed by Data

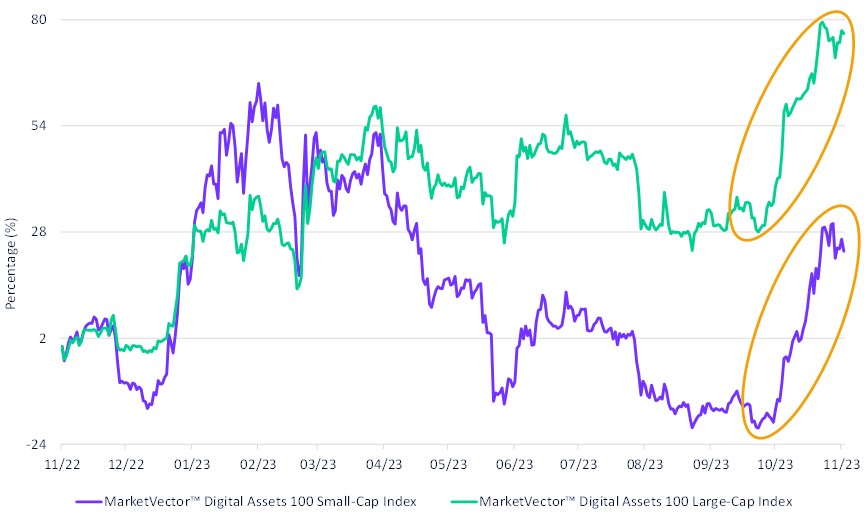

Contrary to the usual trend of large-cap tokens outperforming smaller ones, there's been a significant shift in the market. Recent data, particularly the performance of the MarketVectorTM Digital Assets 100 Large-Cap Index (MVDALC) versus the MarketVectorTM Digital Assets 100 Small-Cap Index (MVDASC), reveals insightful trends. Since the banking crisis in March, large-cap tokens have been increasing. However, in the last four weeks, there's been a notable shift, signaling a rotation into smaller altcoins.

Cumulative Return

21/11/2023-21/11/2023

Source: MarketVector. Data as of November 21, 2023.

This shift is further evidenced by the growing interest and investment in smaller altcoins, especially in sectors like DeFi (Decentralized Finance) and infrastructure, and in smart contract platforms such as Solana.

Understanding Sector Rotation in Bull Markets

The concept of sector rotation is crucial in understanding these market dynamics. Typically, bull markets are accompanied by sector rotation – a process where investment flows move from one market sector to another. The current decline in the large-cap to small-cap ratio reflects this rotation, indicating a potential bull market in the smaller altcoin sector.

Caution is Key: Navigating the Altcoin Rally

While the shift towards smaller altcoins presents exciting opportunities, caution remains essential. The rally in altcoins, particularly given Ethereum's underperformance, seems premature. Investors chasing this trend might face risks if the market adjusts to correct this anomaly.

The anticipated Ethereum ETF adds another dimension to this scenario. Its introduction could potentially shift market focus back to larger coins, aligning with traditional market behavior.

Final Thoughts

In the ever-changing landscape of cryptocurrencies, shifts like these are not uncommon. However, they require a measured approach. The current inclination towards smaller altcoins, backed by data on sector rotation, warrants a cautious strategy. The market is still finding its balance, and as always, it's crucial for market participants to stay informed and agile in their decisions. Remember, in the crypto market, today's trend could be tomorrow's history.

Get the latest news & insights from MarketVector

Get the newsletterRelated: