In a recent development, Japan slipped into a technical recession causing it to drop to the 4th position globally in terms of GDP. This downturn was expected due to a sustained slowdown in spending by businesses and consumers alike. For instance, the Consumer Price Index (CPI) has seen a decline from 3.3% in August 2023 to 2.2% in February 20241. Consequently, this can be largely attributed to businesses grappling with inflationary pressures stemming from rising costs of raw materials and food prices, which have surged to unprecedented levels, thereby depreciating the Yen. Though Yen’s weakening did spark some positive developments. Japan's export sector received a significant boost, which was also driven by global demand for semiconductor manufacturing equipment and automobiles. Additionally, the NIKKEI 225 index reached an all-time high, surpassing its peak from December 1989.

Currently, the economy is at a critical juncture, supported by the Bank of Japan's vigorous efforts to prepare for an exit from its ultra-loose monetary policy as early as this Spring. Additionally, there is a shift in mindset towards enhancing corporate governance and prioritizing the maximization of shareholder value. For instance, the Tokyo Stock Exchange asked all listed companies to enact policies to improve profitability, long-term returns, and valuations. As of today, about 39% of companies in the TOPIX Index (broader-based cap-weighted index for Japan) trade below book value, compared to just 5% for companies in the S&P 500 Index. Another major initiative is the expansion of the Nippon Individual Savings Account (“NISA”), with the government expanding the program and extending its tax-exempt status, with a goal of major growth of individual investor allocation to Japanese stocks.

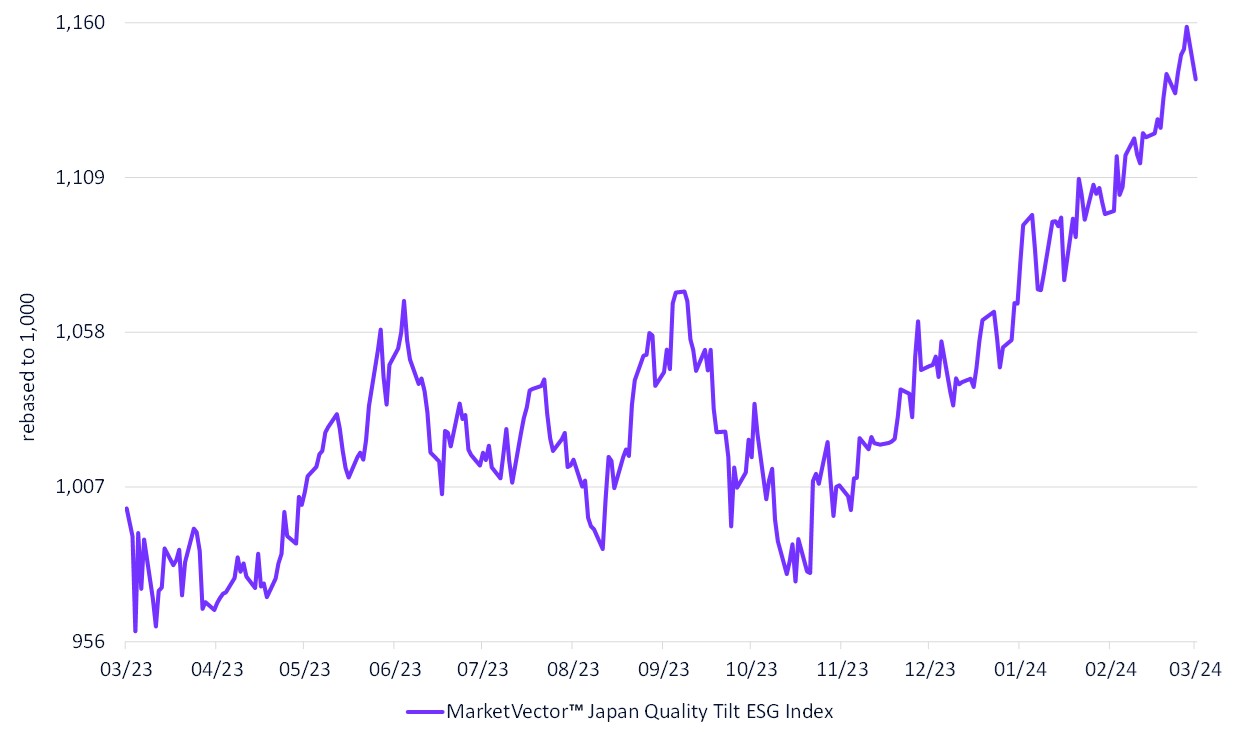

The MarketVectorTM Japan Quality Tilt ESG Index (MVJPNQ), which was up 17.7% YoY tracks the performance of 500 of the largest companies that are incorporated and listed in Japan. The index is weighted by a combination of float-adjusted market capitalization and quality-related factors and adheres to ESG criteria. It is constructed in a similar broad-based manner as Japan’s TOPIX index. Japan’s recent market rally, followed by potential policy changes could trigger a valuation correction for the undervalued stocks in this index which should be a powerful attribute for MVJPNQ.

MarketVectorTM Japan Quality Tilt ESG Index

3/11/2023-3/11/2024

Source: MarketVector IndexesTM. All values are rebased to 1,000. Data as of March 11, 2024.

Source1: https://www.investing.com/economic-calendar/national-cpi-992

For more information on our family of indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: