With less than 100 days until the election and Joe Biden withdrawing from the race, we get a much clearer picture as to what the next four years could look like under either Donald Trump or Kamala Harris. Investors are responding accordingly.

The “Trump trade” refers to a market movement phenomenon in anticipation of another Trump presidency. For many, this is positive for the market, as Trump signals he wants to cut inflation.1 However, the previous Trump era was unpredictable, full of chaos and market volatility, even until its very end.

As part of his re-election campaign, Donald Trump has clearly stated his stances on a number of issues, such as defense, oil and gas, cryptocurrency, trade policies, among others. By examining his 2017-2021 presidency, there has been delivery on some of his promises in the past.

Impact of Trump's policies on key market sectors

On March 28, 2017, Trump’s Energy Independence Policy Executive Order (E.O. 13783) reversed environmental protections enacted under President Obama, loosening standards for oil and gas companies.2 In the last week of 2017, Trump signed into law H.R.1370, which allocated USD 4 billion in missiles and USD 700 million in additional defense technology.3

On January 23, 2018, Trump issued Proclamation 9693 and Proclamation 9694, imposing tariffs on Chinese solar panels and washing machines and effectively creating a trade war between China and the United States. Trump has seemed to shift his view on digital assets, changing his tune from being firmly against to actively criticizing his opponent, Harris, for not being pro-crypto enough.4

Market reactions to Trump’s re-election campaign

Earlier in July 2024, prices fell for the first time in 4 years, which gives growing confidence in the Fed cutting interest rates come September.5 This belief, coupled with a looming Trump presidency, could cause a major shift in investment away from tech and towards less booming area of the market.

No one truly knows how future Trump policies will affect the economy, especially because many of his policies could turn out to be contradictory in practice. Based on his recent public speaking appearances and the general GOP platform, we can predict that he will make tax cuts, enact tariffs with the goal of promoting American businesses and hindering Chinese imports, specifically of electric vehicles, increase natural resource production in favor of oil and gas to lower consumption of renewable energy, bolster US defense capabilities, and limit regulation on cryptocurrency and digital assets.

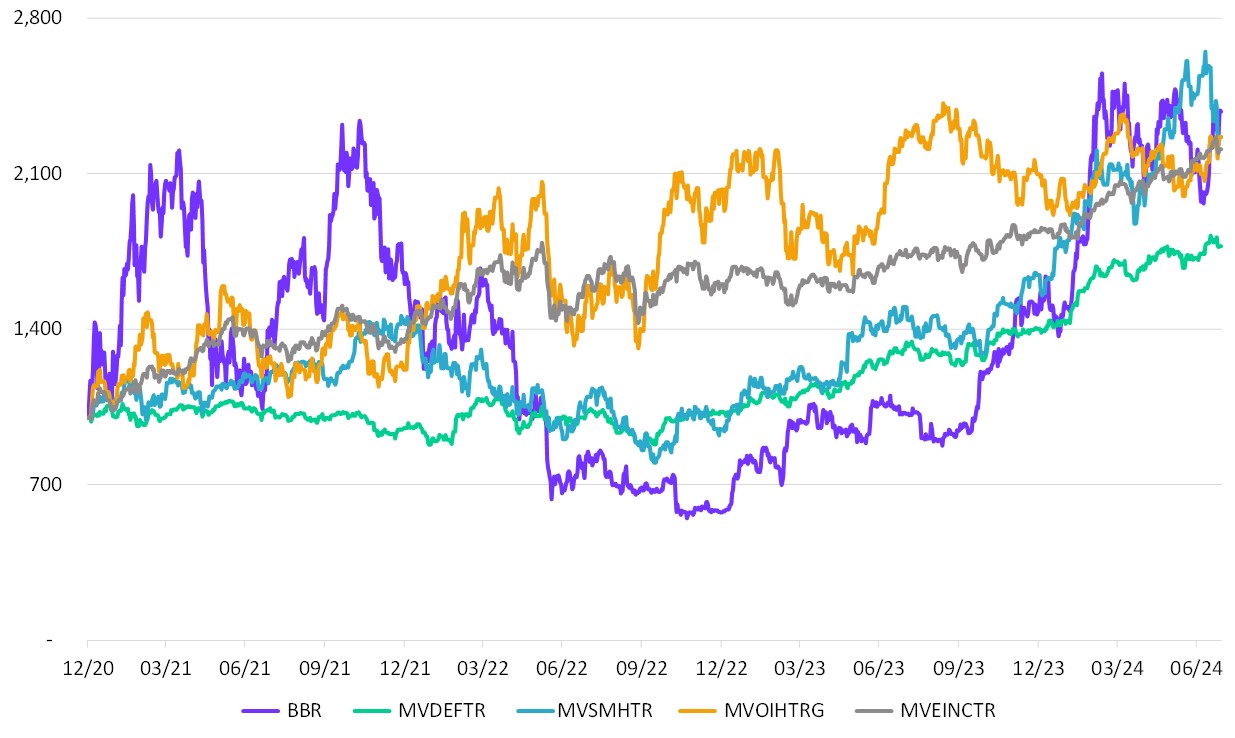

Key market indexes to monitor

Below are 5 MarketVector indexes to keep an eye on over the next 4 months during Trump’s campaign, and potentially the next 4 years if Trump succeeds in winning a second term.

- MarketVectorTM Bitcoin Benchmark Rate (BBR)

- MarketVectorTM Global Defense Industry (MVDEF)

- MVIS® North American Energy Infrastructure Index (MVEINC)

- MVIS® US Listed Oil Services 25 Index (MVOIH)

- MVIS® US Listed Semiconductor 25 Index (MVSMH)

Monitoring Trump Trades with MarketVector

Source: MarketVector. Data as of July 28, 2024.

Source2: https://www.presidency.ucsb.edu/documents/donald-j-trump-event-timeline

Source4: https://www.cnn.com/2024/07/27/politics/donald-trump-bitcoin-cryptocurrency/index.html

For more information on our family of indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: