State of the Crypto

February 2020

By Quynh Tran-Thanh, Chief Product Officer, CryptoCompare

When Bitcoin was first created, its early adopters invested their time and energy into what was essentially a small scale science experiment. One early adopter in 2010 infamously paid 10,000 BTC for two pizzas. Back then the bitcoiner Laszlo Hanyecz made a very good deal. He gave someone a highly illiquid digital asset that he had minted on his laptop in exchange for food. Nowadays, 10,000 BTC is worth over $93 million.

Hanyecz has on several interviews made it clear he doesn’t regret the deal: it helped bitcoin grow. 10 years on and the Bitcoin network cleared a total of $2.5 trillion in a single year. So what's the state of the crypto 10 years since bitcoin was created?

Bitcoin as Digital Gold

While the pizza deal was made when BTC was barely a year old, it’s been a decade since the cryptocurrency was created and so far it hasn’t failed Its security hasn’t been compromised, its core features have been maintained and the cryptocurrency has since evolved to become the equivalent of digital gold, or gold 2.0.

Many investors value bitcoin for its censorship-resistant features and its potential use as a safe-haven asset. On several occasions, the price of bitcoin has risen when equity markets dropped amid volatile world events. Its 2020 high came shortly after Iranian missiles struck U.S. and coalition bases in Iraq.

Decentralized Finance is Here to Stay

The second-largest cryptocurrency by market capitalization, Ethereum, has seen a major use case emerge: decentralized finance. Using the Ethereum blockchain and stablecoins issued on it – including PAX, USDT, GUSD, and DAI – users can earn interest on their digital asset holdings, take out loans, and access other financial services.

Decentralized financial applications currently have a total of $850 million worth of cryptocurrency locked in them, with loans and interest-bearing accounts among the features attracting investors.

Institutional Investors’ Demand is Growing

As Bitcoin and other cryptocurrencies have emerged as a new asset class, institutional investors are starting to enter the space. While current figures show institutional demand isn’t overwhelming, they do show institutions are getting on board.

Custody services have been reporting higher volumes, and crypto-asset manager Grayscale saw a record-breaking 2019 with $600 million invested in its products.

In its “2019 Digital Asset Investment Report,” Grayscale noted that 71% of the money came from institutional investors, 24% of which were new clients. Grayscale’s Bitcoin Trust (GBTC), a product that allows investors to gain exposure to bitcoin without managing any private keys, saw investors pour in nearly $200 million in Q4 2019 alone.

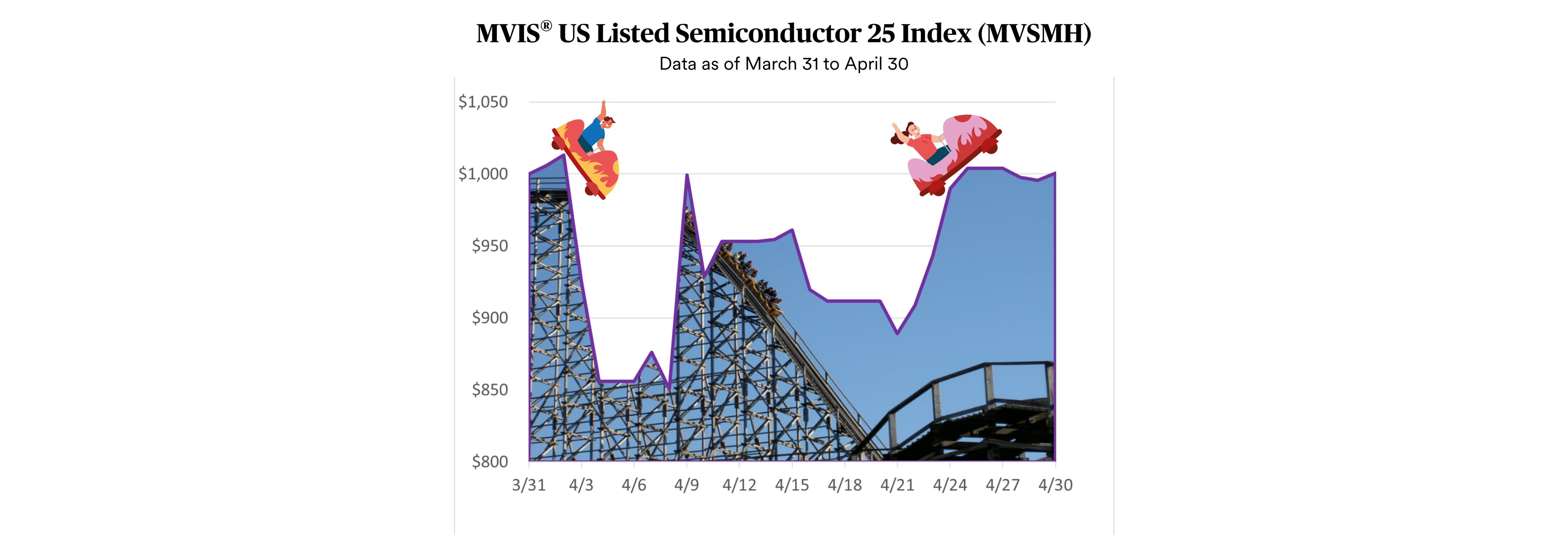

Large-Cap Digital Assets Outperform Small-Cap

Large-cap digital assets - led by bitcoin - have had a strong year and significantly outperformed small-cap digital assets. During the 2017-18 bull market the small-cap digital assets were the highest returning sector of the top 100 digital assets.

Over the past two years, however, bitcoin dominance has grown - as investors funnel money out of the more experimental and speculative small-cap digital assets and into the safer, more established large-caps.

Over the last 9 months the MVIS CryptoCompare Digital Assets 100 Large-cap index is up over 100%, while the small-cap index is down 20%.

Source: MV Index Solutions.

Scaling is Still an Issue

Bitcoin’s sudden growth over the past decade led to an intense scaling debate that saw two sides part ways: one went with BTC itself, while the other moved to a new blockchain supporting bigger blocks, known as Bitcoin Cash (BCH). This community separated even further in 2018, as one side moved on to support even bigger blocks while rejecting other technological features, to form Bitcoin SV (BSV).

Transaction fees on the Bitcoin blockchain hit $50 in December 2017 when BTC was close to its near $20,000 all-time high. Bigger blocks make it harder for individual users to run nodes and verify transactions but reduce transaction fees. While BCH and BSV supporters believe risking centralization is a price worth paying, BTC supporters are looking to solutions built on top of the blockchain to keep the cryptocurrency as decentralized as possible.

As Bitcoin enters its second decade, it is trading above $9,000 and its total market cap stands at $170 billion. 18.18 million BTC are now circulating, out of its total supply of 21 million. Bitcoin’s layer-two scaling solutions, Ethereum’s move to a different consensus algorithm, and the growth of decentralized finance all serve to show that this exciting asset class is poised to continue to innovate growth and break new ground in the 2020s.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Quynh Tran-Thanh joined CryptoCompare three years ago to build data products and has been since responsible for quantitative methods, methodologies and research within the business. Previously she worked in investment banking as a quant analyst for credit derivatives.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.