Digital assets have gained steady recognition over the past several years. We believe that, under the right market conditions, digital assets have the potential to integrate with the broad economy and become an investable asset class in their own right. For that reason, we believe that digital assets merit proper monitoring as a distinct asset class.

There are many different types of digital assets. For example, Bitcoin, Ether and Litecoin are cryptographically secured, protocol-governed, and mostly non-centrally issued assets that can serve as stores of value, mediums of exchange, or technology investments.

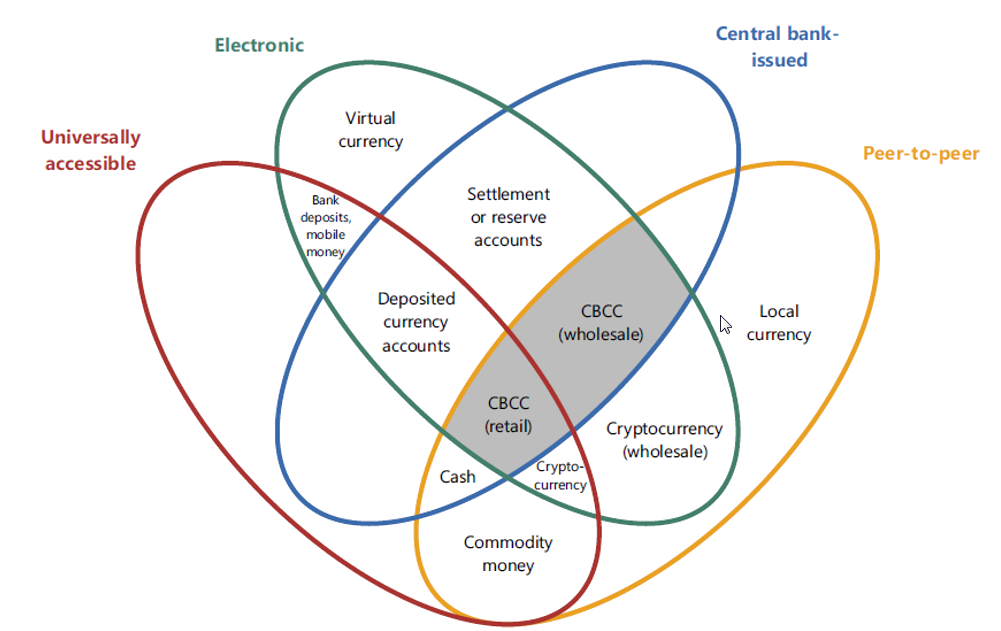

“Cryptocurrencies”, such as those mentioned above, are just one type of digital asset, but are becoming increasingly important as distributed ledger technology gains acceptance, as illustrated by the Bank of International Settlements’ “Money Flower”.

The money flower: a taxonomy of money

Source: Bank of International Settlements

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Gabor Gurbacs is the Director of Digital Asset Strategy and former member of the ETF product management team at VanEck. Mr. Gurbacs has extensive digital asset trading and market structure experience on global digital asset trading platforms and he is well known in the digital asset community. Prior to joining VanEck, Mr. Gurbacs was a George Soros Scholar, Edgar Bronfman fellow, serial entrepreneur, and holder of several new economy finance research positions at the Massachusetts Institute of Technology (MIT), Harvard, and Williams College. Mr. Gurbacs earned a BA from Williams College, triple majoring in Mathematics, German and Sociology.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.