As the digital assets industry continues its efforts to popularize itself with the everyday investor, certain aspects of the cryptocurrency space has shifted – the first bitcoin ETFs have been launched, regulation is slowly being implemented, and coins are steadily being categorized into different sectors, much like equities.

However, there is still one aspect of the digital assets industry that has yet to see any real change: price stability of individual coins.

The volatility of cryptocurrencies is as present as ever and makes for a great daily guessing game. The question isn’t whether coins will see volatility, but rather to what degree of volatility will coins see. Sometimes these prices changes come in the form of waves, with ebbs and flows, and sometimes they come in the form of an avalanche – quite literally.

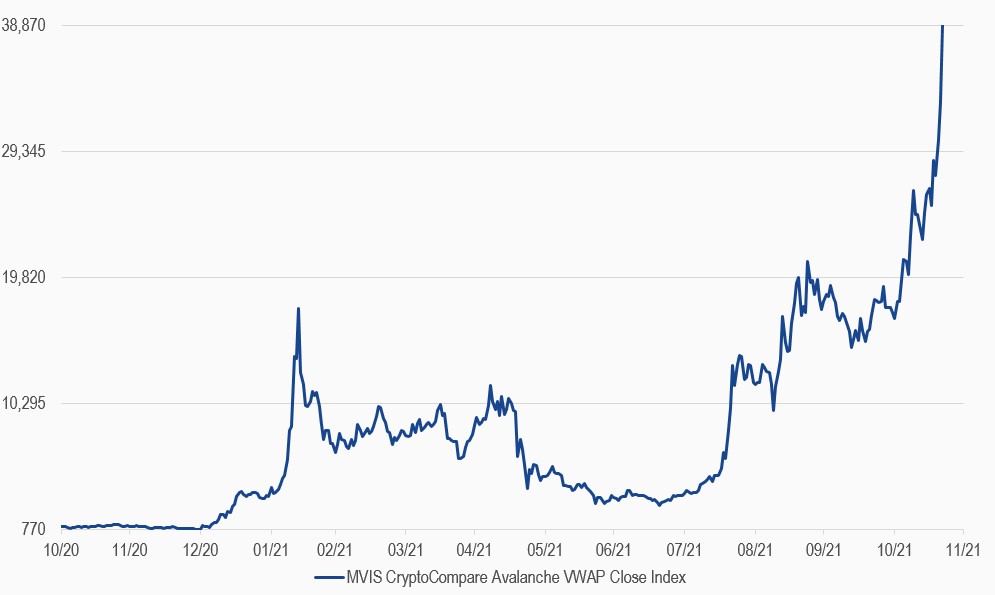

On Sunday 21st November, the cryptocurrency coin Avalanche, reached an all-time high price of $144.96 a coin – more than doubling its market cap in the three weeks prior. As of that Sunday, the coin’s $31.5 Billion market cap was the 10th largest amongst all cryptocurrencies. Avalanche, which was developed by Ava Labs, had seen a 3,000% increase in its market cap over the last year. However, in the last 10 days, it has seen a wild swing in its market cap, from a high of over $32 billion to just under $23 Billion to back up to over $27 Billion, as of Tuesday, November 30th.

Avalanche is just the latest cryptocurrency coin to see wild swings in its market cap valuation. Avalanche’s rise falls on the heels of some wild price fluctuations for other notable coins in recent months, such as Dogecoin and Shiba Inu – two of the coins that Avalanche surpassed on its rise to being the 10th largest coin by marketcap.

MVIS CryptoCompare Avalanche VWAP Close Index

31/10/2020-21/11/2021

Source: MV Index Solutions. All values are rebased to 100. Data as of 21 November 2021.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Steven Braid is a Data and Marketing Analyst at MV Index Solutions. He is responsible for supporting the data, marketing, research, and product services. Prior to working for MVIS, Steven worked as an equity research analyst for Dane Capital Management, a special situations hedge fund, where he focused on SPACs and other forms of special situation transactions. Prior to his time in Finance, he worked as a professional journalist, publishing for the New York Times, USA Today, and other national periodicals. Steven has a M.S. in Data Analytics & Applied Research from the Baruch College Zicklin School of Business, and a BA in International Political Economy from the University of Michigan.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.