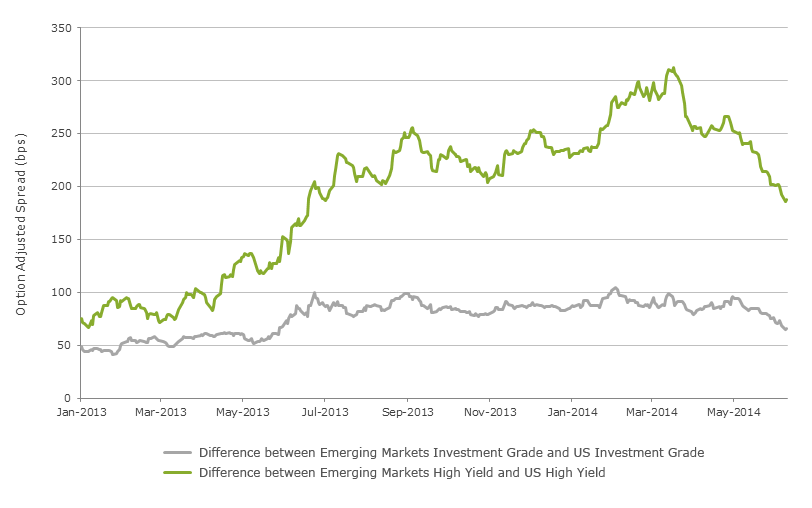

Over the past decade a bellwether for risk appetite has emerged within the fixed income world: emerging markets corporate debt. Here are a few facts you should probably know about this asset class:

- It is approximately twice the size of the emerging markets sovereign external debt universe.

- It is 70% investment grade.

- Dedicated assets under management in the space are a fraction of the assets in either sovereign external or local debt.

- Crossover demand has heightened volatility in the asset class. As more dedicated funds emerge, this effect may continue to diminish.

All data as of 10 June 2014. Source: Merrill Lynch

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Francis G. Rodilosso, CFA (MBA ─ with distinction, Finance, The Wharton School, University of Pennsylvania; BA, History, Princeton University, 1990).

Fran serves as Senior Investment Officer for Van Eck’s fixed-income exchange-traded funds (ETFs) and Portfolio Manager for taxable fixed-income ETFs. He is responsible for portfolio strategy, credit and market analysis. Fran previously held positions at the Seaport Group (Managing Director of Global Emerging Markets), Greylock Capital, Soundbrook Capital, Credit Lyonnais and HSBC.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.