The World Gold Council (WGC) recently released its third quarter Gold Demand Trends. Year-to-date demand totaled 2,972 tonnes, 10% below the same period in 2019. The pandemic caused jewelry and central bank demand to plummet; jewelry demand is down 42% from last year, while central banks bought 66% less. This was partially offset by record investment demand from gold bullion exchange traded products (ETPs) and strong bar and coin demand. (We expect pandemic-related demand weakness to continue into 2021.)

According the WGC, year-to-date, total mine supply of 2,477 tonnes was down 5% from last year due mainly to lockdowns earlier in the year. Recycled scrap, at 944 tonnes, was roughly equal to last year. Total supply of 3,421 tonnes resulted in a substantial surplus of 449 tonnes. Despite the 15% supply surplus, the gold price has gained 23.8% this year.

As we always tell investors, physical supply-demand fundamentals used for other commodities don’t work for gold. Unlike other commodities, gold is a financial asset that is hoarded like stocks, bonds or currency. This year’s surplus is a drop in the ocean relative to the above-ground stock of gold, which the vast majority of owners are happy to keep at current prices. Bull markets are driven by investment demand for gold as a safe haven and store of wealth.

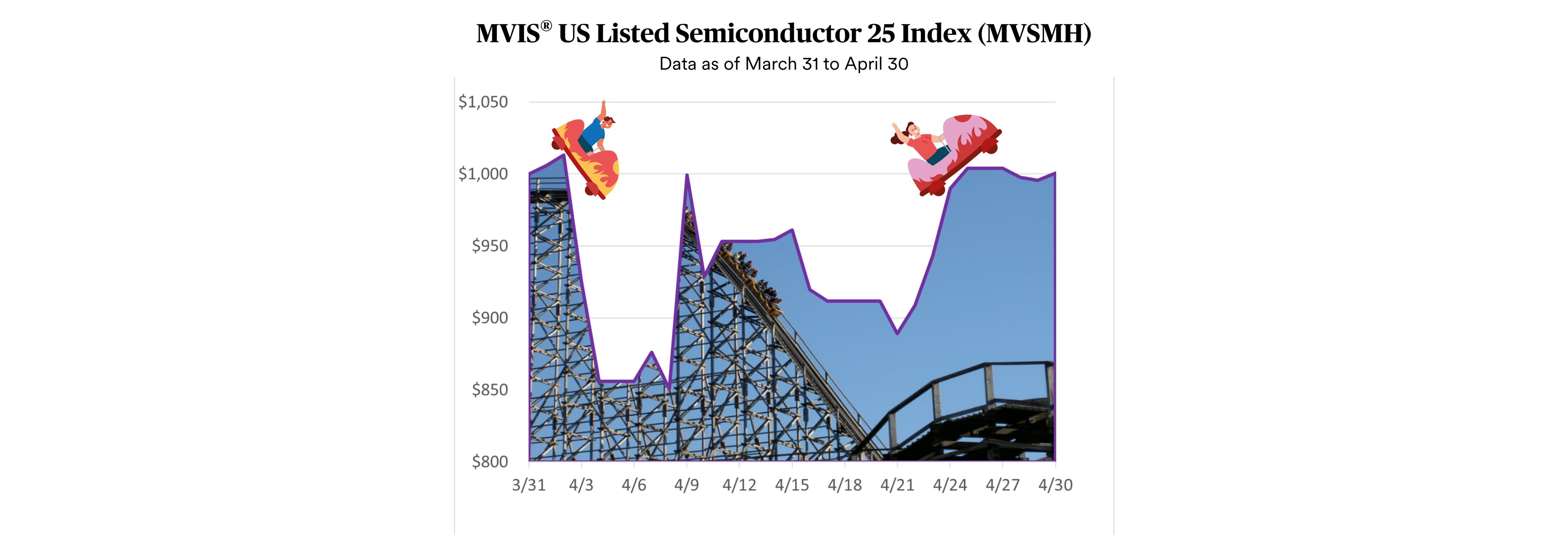

MVIS Global Junior Gold Miners Index vs. Gold Price

10/31/2019-10/31/2020

Get the latest news & insights from MarketVector

Get the newsletterRelated:

Joe Foster has been Portfolio Manager for the VanEck International Investors Gold Fund since 1998 and the VanEck – Global Gold UCITS Fund since 2012. Mr. Foster, an acknowledged authority on gold, has over 10 years of dedicated experience in geology and mining including as a gold geologist in Nevada. He has appeared in The Wall Street Journal, Financial Times, Barron's, and on Reuters, CNBC and Bloomberg TV. Mr. Foster has also published articles in a number of mining journals, including Mining Engineering and Geological Society of Nevada.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.