The gold mining sector of the recent past was characterized by the pursuit of growth at any cost, which led to over spending, high costs, and poor returns on investments. A change was needed, and companies have now been reconfigured. They are focused on cutting operating and capital costs, reducing corporate overhead, increasing profitability and returns on capital, reducing debt, increasing cash balances, and simplifying projects and management structures. A few quarters of results suggest that their initiatives are working. And encouragingly, companies remain committed, reiterating their focus on further increasing operating efficiency, reducing costs, and enforcing capital discipline.

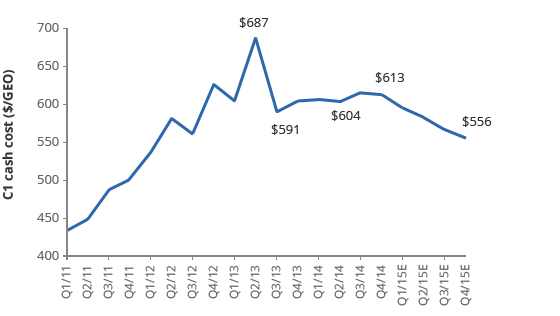

Cash Operating Costs

Source: Goldman Sachs Global Investment Research

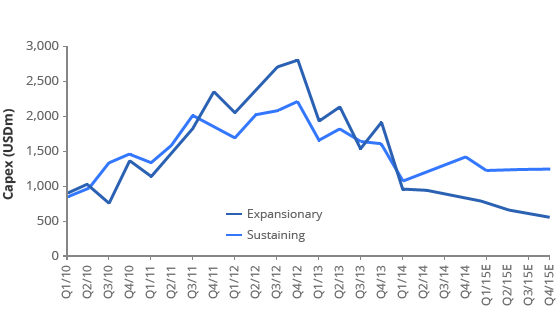

Mine Capex per Ounce

Source: Goldman Sachs Global Investment Research

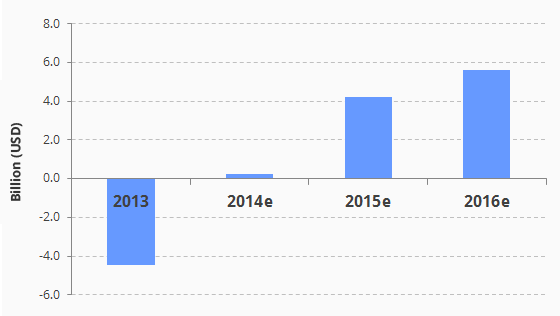

Aggregate Gold Industry Free Cash Flow

Gold price assumptions: 2014e $1,308, 2015e $1,341, 2016e $1,428 (at 2016e $1,200 CF = $4B)

Source: BofA Merrill Lynch Global Research August 2014

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Imaru Casanova holds an appointment as senior gold analyst at VanEck. Mrs. Casanova is a proven expert on gold and gold mining and has been quoted, inter alia, in Barron’s, USA Today, Investor’s Business Daily and has appeared on CNBC.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.