Merger and acquisition (M&A) activity continues at a measured pace. Historically, acquisitions at a premium have dominated M&A activity. This has led to too many companies overpaying for assets that failed to deliver the expected performance. However, in the current bull market, mergers of equals have become more common as companies find ways to increase value and shareholder returns, rather than overspending to grow ounce production to simply get bigger.

As the gold price has trended higher, we have found both this shift in strategy and greater discipline to be firmly in place.

Amongst other things, we are observing:

- A focus on stable production and margin improvement through reducing costs.

- The generation of free cash flow to return to shareholders and reduce debt.

- The funding of lower cost, higher return organic and brownfield expansions.

- Continued use of $1,200 - $1,250 per ounce gold prices to run reserve calculations and no chasing of marginal low-grade ounces.

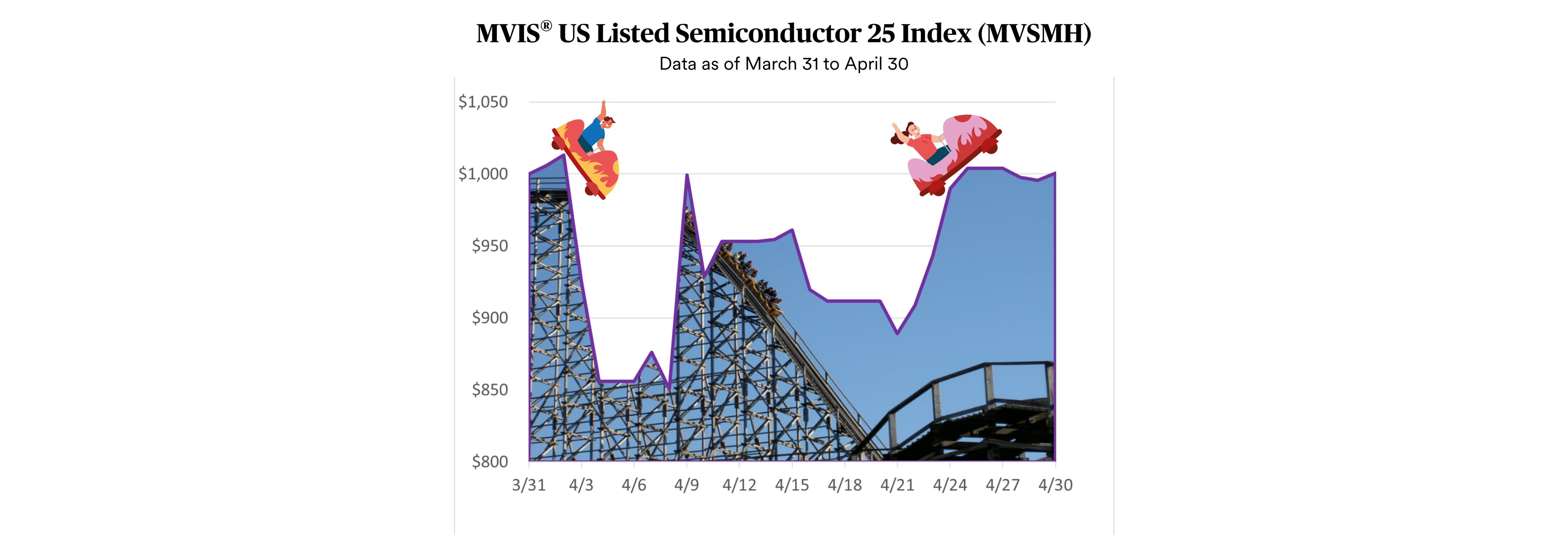

Unlike 2001 – 2011 Bull Market, Costs Remain in Check With

Rising Gold Price

Source: BMO Capital Markets. Data as of May 2020.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:Joe Foster has been Portfolio Manager for the VanEck International Investors Gold Fund since 1998 and the VanEck – Global Gold UCITS Fund since 2012. Mr. Foster, an acknowledged authority on gold, has over 10 years of dedicated experience in geology and mining including as a gold geologist in Nevada. He has appeared in The Wall Street Journal, Financial Times, Barron's, and on Reuters, CNBC and Bloomberg TV. Mr. Foster has also published articles in a number of mining journals, including Mining Engineering and Geological Society of Nevada.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.