The price of gold now appears to be poised to remain above the technically and psychologically important level of USD 1,200 per ounce and looks likely to trend higher in 2016.

Despite this rally in the price of gold and the higher cash flows that come with it, it is encouraging that the management teams of the gold miners with whom we have recently met remain firmly committed to growing profitability and returns rather than production.

We heard more than once in our discussions that a new ounce of production is only good, and will only be added, if it improves or maintains the existing per ounce profitability of the company. Their initiatives have slowly and cautiously started to shift from mere survival to thriving. But «caution» remains the name of the game.

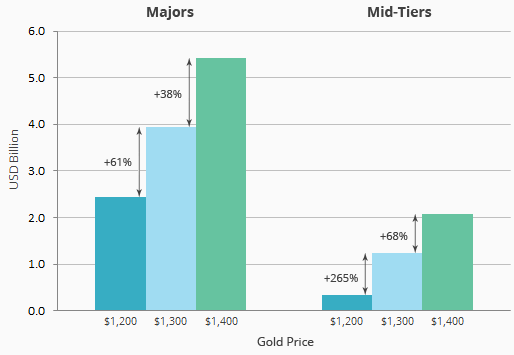

Free Cash Flow with Gold at USD 1,200 to USD 1,400 – 2016 Estimates

Source: VanEck Research. Data as of March 2016

Get the latest news & insights from MarketVector

Get the newsletterRelated: