So far in 2016, gold stocks have soared – both junior and larger mining companies. Here, we believe, are several reasons why:

- There have been positive changes in both sentiment and the investment demand for gold.

- Companies have successfully slashed costs, cut debt, gained efficiencies, and generated cash.

- There has been mean reversion in a sector that had been oversold during the worst bear market in history.

- The short selling pressure that had been weighing on gold and gold stocks since they crashed in 2013 has been eliminated.

- There is limited liquidity in a relatively small sector with a global market cap of around $250 billion.

We expect that there will probably be a brief correction at some point this year, potentially providing an entry point for those investors who, so far, have missed this year's rally.

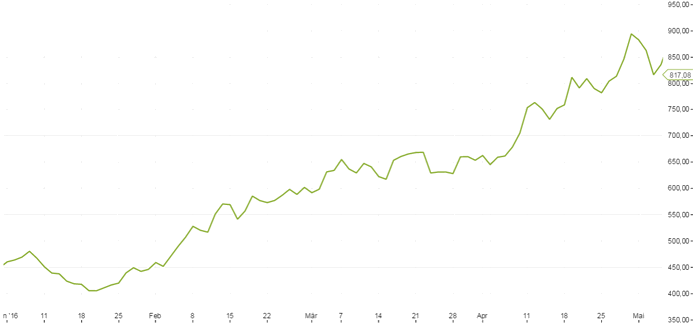

MVIS Global Junior Gold Miners Index – Performance YTD

Source: MV Index Solutions

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Joe Foster has been Portfolio Manager for the VanEck International Investors Gold Fund since 1998 and the VanEck – Global Gold UCITS Fund since 2012. Mr. Foster, an acknowledged authority on gold, has over 10 years of dedicated experience in geology and mining including as a gold geologist in Nevada. He has appeared in The Wall Street Journal, Barron's, and on Reuters, CNBC and Bloomberg TV. Mr. Foster has also published articles in a number of mining journals, including Mining Engineering and Geological Society of Nevada.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.