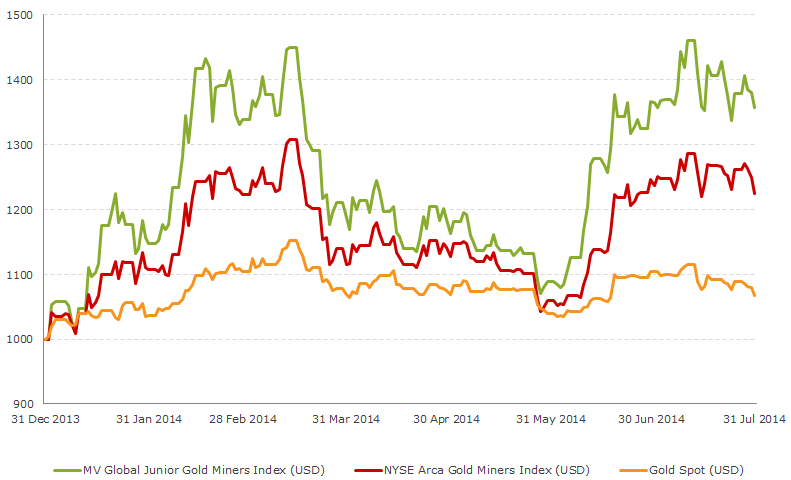

Junior gold miners continue to outperform their large- and intermediate-cap peers this year. As they have from January 1.

Source: Bloomberg

Whilst juniors may have underperformed in 2013, the pick-up in M&A activity is certainly contributing to their strength in 2014.

The merger of junior producer Rio Alto Mining and developer Sulliden Gold is a very good example of the type of transaction from which the sector can benefit. Amongst the most attractive elements of the deal are the following:

- the proximity of each company's assets – within 30 kms of each other in Peru;

- the fitting combination of a producing, cash flow generating mine with a development project; and,

- the appealing possibility of a re-rating of the shares of Rio Alto, generally perceived by the market as a future copper company, via the coveted gold equity premium.

With valuations of gold companies at historically low levels, we could see further consolidation in the sector as the year progresses.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Imaru Casanova holds an appointment as senior gold analyst at VanEck. Mrs. Casanova is a proven expert on gold and gold mining and has been quoted, inter alia, in Barron’s, USA Today, Investor’s Business Daily and has appeared on CNBC.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.