2022 started the year, with a falling and volatile stock market driven by war in Ukraine and rising inflation concerns in the United States. Inflation hit an all-time high of 7.9% in the US triggered by severe supply chain issues combined with high liquidity created by generous pandemic bail outs. The Fed, hoping to contain inflation and its fallout, announced a series of quarter point raises in interest rates over the quarter. Russia invaded Ukraine in February, and hopes of a quick Russian victory were immediately dashed by a determined Ukrainian defense and a coordinated, worldwide condemnation of Russia. This is easily the worst attack on European soil since World War II. Global events of this magnitude have kept the markets unsettled, choppy and on an overall downward trend. Energy prices spiked to an all-time high of $150 per barrel, a reversal from historic negative rates just two years ago.

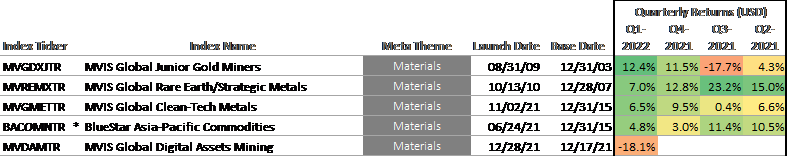

Fears of inflation and global political turmoil invariably provide a boost to Gold which is often viewed as a safe haven. The MVIS Global Junior Gold Miners Index (ticker: MVGDXJ) returned 12% this quarter with gold, a store of value with limited supply, proving to be a natural save haven. The index consists of smaller sized gold miners like Evolution Mining from Australia and Yamana Gold from the US. Similarly, other diversified Material thematic indices such as the MVIS Global Rare Earth/Strategic Materials Index (ticker: MVREMX) and the MVIS Global Clean-Tech Metals Index (ticker: MVGMET) were also up 7% and 6.5% over the quarter. MVREMX and MVGMET also embed higher prices from the supply shock around many metals with Russia as a major exporter of aluminum, steel, palladium and nickel. These indices provide a more diversified approach to rare metals and global companies involved in rare earth element mining, refining, and recycling.

Materials Meta Theme

Source: MV Index Solutions. Total Return Indices, *Net Total Return Indices. Data as of 31 March 2022.

For the complete overview of Q1 2022 Meta Theme performance, please refer to our Quarterly Thematic Index Performance Review, here: Quarterly Thematic Paper.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Joy Yang is Global Head of Index Product Management at MV Index Solutions (MVIS). She is responsible for managing MVIS products and services to accelerate innovation in financial index design and adoption. Joy brings more than 25 years of investment experience to MVIS, having led teams delivering index and quantitative-active investment solutions at Arabesque Asset Management, Dimensional Fund Advisors, Vanguard, Aberdeen Standard Investments, AXA Rosenberg and Blackrock. Joy has an MBA from the University of Chicago Booth School of Business, and a BS in Electrical Engineering from Cooper Union’s Albert Nerken School of Engineering.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.