Gold stocks went on a bigger roller coaster than gold in 2022. Cost increases combined with lower gold prices caused some companies to miss earnings. The industry guided to cost increases in the five percent range early in the year, however, higher commodities prices brought on by the Ukraine war forced many companies to revise costs higher.

It looks like 2022 costs will average around $1,200 per ounce, up about 10% over 2021. While a couple of companies plan on trimming dividends, most dividends remain intact and stock buybacks have continued along with healthy margins. The recent positive gold price trend along with early indications that costs should remain around current levels bodes well for gold miners in 2023.

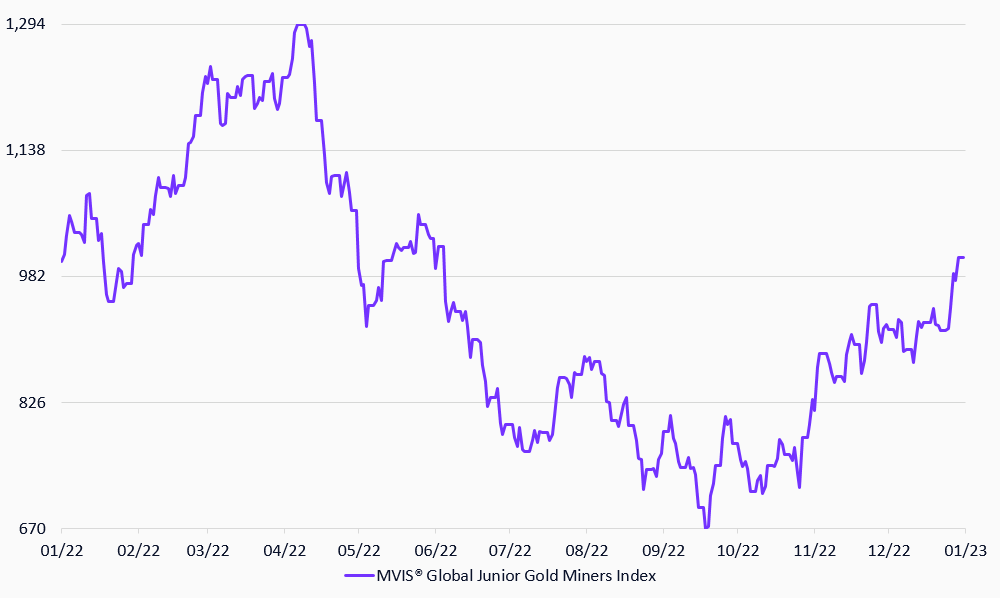

MVIS® Global Junior Gold Miners Index

9/1/2022-9/1/2023

Source: MarketVector IndexesTM. All values are rebased to 1,000. Data as of January 9, 2023.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Joe Foster has been Portfolio Manager for the VanEck International Investors Gold Fund since 1998 and the VanEck – Global Gold UCITS Fund since 2012. Mr. Foster, an acknowledged authority on gold, has over 10 years of dedicated experience in geology and mining including as a gold geologist in Nevada. He has appeared in The Wall Street Journal, Financial Times, Barron's, and on Reuters, CNBC and Bloomberg TV. Mr. Foster has also published articles in a number of mining journals, including Mining Engineering and Geological Society of Nevada.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. Inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.