There are a large number of variables, both broad and specific, to consider when it comes to investing in gold. And, when it comes to investing in gold mining, an even larger number of variables and additional risks need to be considered.

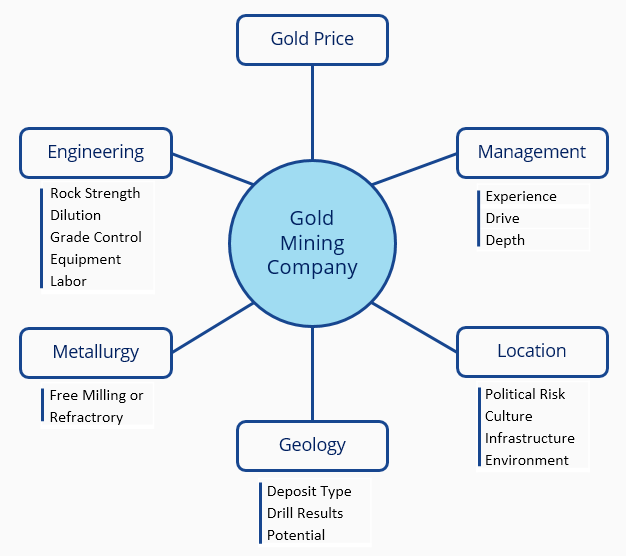

Certainly, the gold price is the most important variable driving the performance of gold mining stocks. However, in addition, gold companies are exposed to geological, technical, and operating risk as well as country-specific and regulatory risk.

Many of the factors can change rapidly and, therefore, frequent assessment is imperative. But the unpredictability of many of the changes means that trying to time them is quite risky. Thus, a sound investment strategy in the gold sector must also be driven and supported by a longer term view.

Some Analytical Basics

Source: VanEck

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Imaru Casanova holds an appointment as senior gold analyst at VanEck. Mrs. Casanova is a proven expert on gold and gold mining and has been quoted, inter alia, in Barron's, USA Today, Investor's Business Daily and has appeared on CNBC.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.