With tensions escalating in Ukraine, western nations impose sanctions that disrupt the Russian markets triggering further actions by Russian central banks to ban brokers from selling securities by non-residents. Surgical strikes on the Russian financial markets have begun to hit and make real damage with markets falling more than half its value and the Russian central bank hiking interest rates to 20%.

At the end of 2021, foreign investors held $20bn in Russian debt and $41bn of rouble-denominated sovereign bonds, Russia accounted for over 2% of emerging market weight by market capitalization, and the AUM in the top 5 Russian ETFs totaled over $2bn.

With allied countries prepared to intervene, money can be a weapon and a significant force.

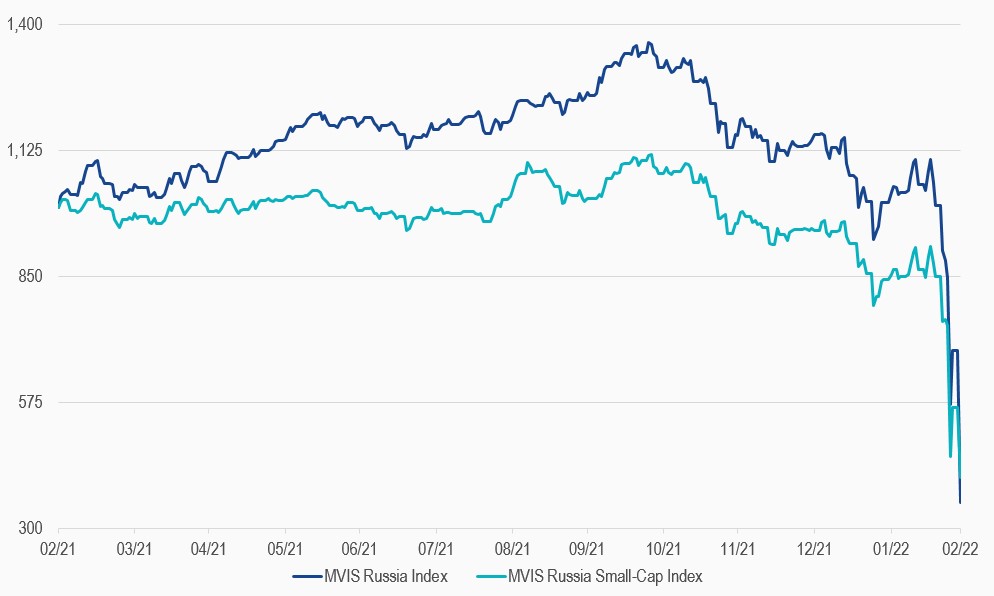

The MVIS Russia Index (ticker: MVRSXTR), an index that tracks the performance of the largest and most liquid companies in Russia, fell over 60% from it’s high on October 26, 2021 to February 28, 2022. Unlike the severe drop during the 2008 Russian-Georgian conflict, where MVRSXTR fell by 80% from May 2008 to February 2009, local markets shut down this time, leaving trading in local shares as well as sanctioned shares in the dark. When investors holding illiquid positions are unable to price their positions, the market often turns to derivative instruments and ETFs that still continue to trade. As ETFs continue to trade, they can take on market sentiment and offer price discovery on the secondary market to investors unable to access the local securities and underlying primary markets. They also provide liquidity to investors who seek immediacy during market turmoil, transferring risk to those who can take it on.

MVIS continues to monitor the changing conditions around the Russian-Ukraine conflict and impact on availability and quality of data input for the index to accurately and reliably reflect the investable Russian market. MVIS will seek to communicate index actions to its clients in as timely manner as events allow. Relevant technical notices will be sent directly to our clients and information will be provided on our website.

MVIS Russia Index and MVIS Russia Small-Cap Index

28/02/2021-28/02/2022

Source: MV Index Solutions, CryptoCompare. Data as of 28 February 2022.

Get the latest news & insights from MarketVector

Get the newsletterRelated: