Despite the bear market we face in crypto land, one coin is holding up well – APE. It is also one of the top most trending cryptos in the last few weeks, according to data on CoinGecko and CoinMarketCap. ApeCoin was officially released on March 16, 2022, as “a token for culture, gaming, and commerce” and is the main cryptocurrency of the Bored Ape Yacht Club ecosystem. The Bored Ape Yacht Club (BAYC) is a popular non-fungible token (NFT) collection based on the Ethereum blockchain and consists of 10,000 unique Bored Ape NFTs. Holders of a Bored Ape NFT were even eligible to claim 10,094 APE tokens for free. A so called airdrop.

The coin has been launched for use within the APE Ecosystem. APE is run by a decentralised autonomous organisation called ApeCoin DAO. According to Yuga Labs, the founding team behind the BAYC, Apecoin holders have governance rights over the DAO and its decision-making, along with some other perks. It serves as a primary settlement token for all the Yuga Labs’ products and services. OpenSea, the world’s leading NFT marketplace, also announced on April 30 that it has started accepting APE for payments on its platform.

The recent rallye was fueled by a lot of speculation due to the sale of more NFTS representing virtual plots of land for Yuga Labs’ upcoming metaverse project called Otherside. The mint price for each land plot was 305 APE, worth around $5,800 at the time of the sale. Over 55,000 Otherdeeds were sold. The project collected about $320 million and logged the "largest NFT mint in history."

The demand was so massive, that the mint caused gas fees on the Ethereum blockchain to skyrocket to 8,000 GWEI as a result of a gas war, as Ethereum users were outbidding each other to try and get their transactions through to mint NFTs. Some buyers spent between $ 6500 to $14000 in gas fees. In total over $ 123 million were paid to enable the transactions. The user experience was so bad that Yuga labs apologized and is willing to refund failed transactions. The even suggested to the DAO to think about their own chain. This again proofs that Ethereum needs more scalability via the Layer2s.

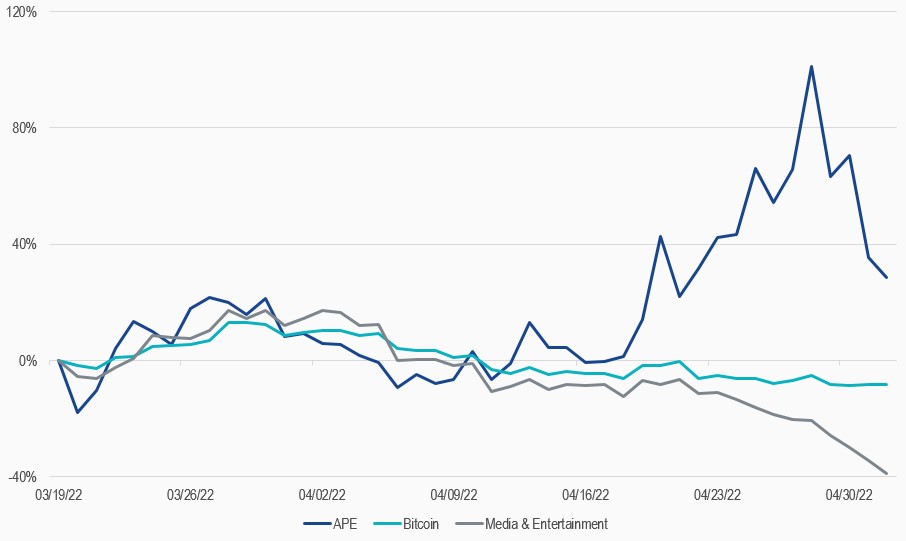

As you can see in Exhibit 1, APE decoupled strongly from our Media & Entertainment Index. It outperformed Bitcoin in a falling market environment. But you can see the speculative character as well. In the last three days, APE lost more than 50%.

The success of APE depends on its further adoption. Game-makers such as Animoca Brands and NWayPlay already announced the this coin will be integrated in future play-to-earn games. Yuga Labs is a master in sustaining the hype for the ecosystem. Announcing airdrops, land sales a potential new chain and a market place. We’ll see how sustainable that is. It’s just another sign how early we are and how narrative driven this space is. Doing your own research is an important part in that space.

Investors unwilling to play the single token game can use our Media & Entertainment index to get exposure to gaming, Metaverse and social token. It’s a diversified play to benefit from increased utility in Web3.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Martin Leinweber is an expert in fundamental and quantitative trading strategies. He sees cryptoassets as a fundamental building block for investors to achieve their return targets in a low interest rate environment. He works as a Digital Asset Product Strategist at MV Index Solutions providing thought leadership in an emerging asset class. His role encompasses product development, research and the communication with the client base of MVIS. Prior to joining MVIS, he worked as a portfolio manager for equities, fixed income and alternative investments for almost two decades. He was responsible for the management of active funds for institutional investors such as insurance companies, pension funds and sovereign wealth funds at the leading German quantitative asset manager Quoniam. Previously, he held various positions at one of Germany's largest asset managers, MEAG, the asset manager of Munich Re and ERGO. Among other things, he contributed his expertise and international experience to the establishment of a joint venture with the largest Chinese insurance company PICC in Shanghai and Bejing. Martin Leinweber is co-author of „Asset-Allokation mit Kryptoassets. Das Handbuch“ (Wiley Finance, 2021). It’s the first handbook about integrating digital assets into traditional portfolios. He has a Master in Economics from the University of Hohenheim and is a CFA Charterholder.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.