Polygon is a set of decentralized scaling solutions for Ethereum that aim to give developers the tools they need to build scalable, user-friendly dApps with low transaction fees and high guarantees of security.

Its business development efforts have proven to be one of the company's strengths, as evidenced by the various relationships the company has established with prominent web2 companies.

Despite the overall NFT market downtrend, Polygon has seen a massive 191% increase in NFT sales since the end of September. In the past few months, there have been strong moves from major Web2 companies trying to fully integrate NFTs into their platforms:

- Starbucks is revamping their rewards program by incorporating Polygon based NFTs.

- Reddit launched a collectible avatar program on Polygon, which has recently onboarded 3 million unique users.

- Meta is creating an NFT marketplace on Polygon to be integrated into their Facebook and Instagram platforms.

The platform is presently dominating the industry in big brand deployments, which could explain the recent increase in NFT revenues.

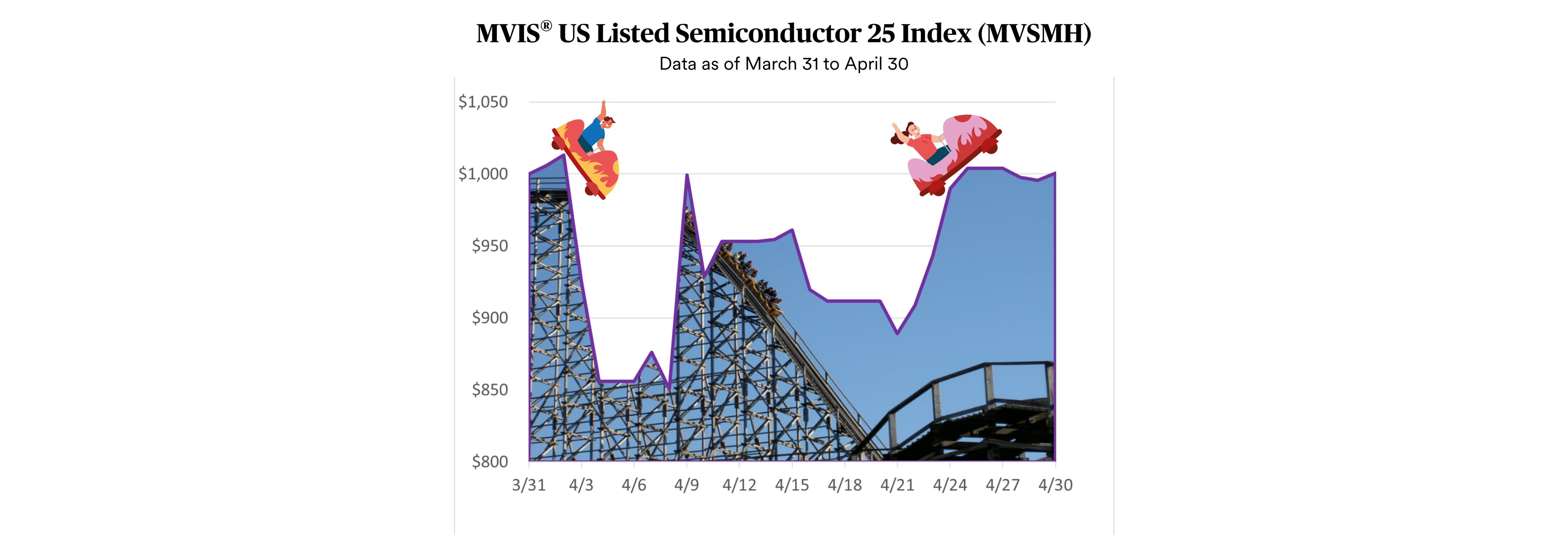

The MVIS® CryptoCompare Polygon VWAP Close Index (ticker: MVMATICV) measures the performance of a digital assets portfolio which invests in Polygon, with a closing value based on a 1h VWAP price.

MVIS® CryptoCompare Polygon VWAP Close Index

5/12/2021-5/12/2022

Source: MarketVector IndexesTM, data as of December 5, 2022.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Martin Leinweber is an expert in fundamental and quantitative trading strategies. He sees crypto assets as a fundamental building block for investors to achieve their return targets in a low interest rate environment. He works as a Digital Asset Product Strategist at MarketVector IndexesTM providing thought leadership in an emerging asset class. His role encompasses product development, research and the communication with the client base of MarketVector IndexesTM. Prior to joining MarketVector IndexesTM, he worked as a portfolio manager for equities, fixed income and alternative investments for almost two decades. He was responsible for the management of active funds for institutional investors such as insurance companies, pension funds and sovereign wealth funds at the leading German quantitative asset manager Quoniam. Previously, he held various positions at one of Germany's largest asset managers, MEAG, the asset manager of Munich Re and ERGO. Among other things, he contributed his expertise and international experience to the establishment of a joint venture with the largest Chinese insurance company PICC in Shanghai and Bejing. Martin Leinweber is co-author of „Asset-Allokation mit Kryptoassets. Das Handbuch“ (Wiley Finance, 2021). It’s the first handbook about integrating digital assets into traditional portfolios. He has a Master in Economics from the University of Hohenheim and is a CFA Charter holder.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. Inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.