In the latest MV Index Solutions (MVIS®) Quarterly Thematic Performance Review (Q2 2021), Clean Energy, as a Meta theme, continued its relative underperformance from Q1 2021 after being one of the top Meta theme performers over the last 3 years. Clean Energy covers companies involved in energy from renewable sources such as solar, wind and hydrogen, as well as companies actively saving energy efficiency measures such as the electric vehicles industry. Indices within Clean Energy will have different drivers of risk and return, materializing in the wide spread of returns witnessed in Q2 2021 ranging from +10% to -10% between the highest Clean Energy Index (BlueStar Electric Vehicle Industry) and the lowest Clean Energy Index (BlueStar Hydrogen and NextGen Fuel Cell).

At MVIS, we recognize that building indices to capture targeted themes goes beyond traditional sector and industry definitions and aim to provide investors with targeted choices that meet their investment goals. MVIS publishes 48 thematic indices to cover forward-looking investment concepts grouped into Meta themes: Clean Energy, Health Care Innovation, Financials 2.0, NextGen Hardware & Communications, NextGen Software, Consumer Trend, Thematic Industrials & Infrastructure, Thematic REITS, Materials, and Disruptive Technology.

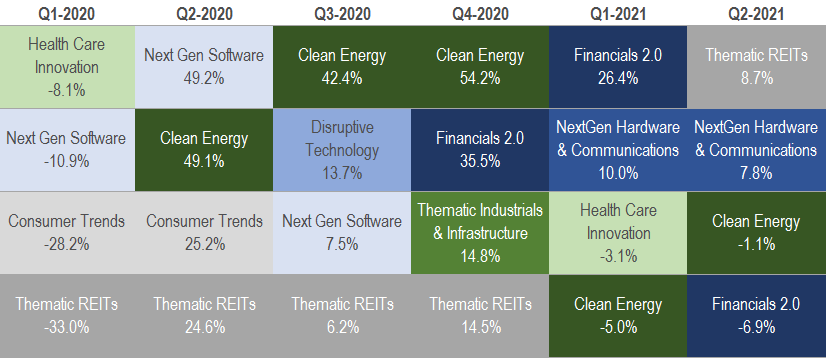

Top and Bottom MVIS Meta Thematic Quarterly Returns (USD)

01/01/2020-30/06/2021

Get the latest news & insights from MarketVector

Get the newsletterRelated: