Last week, on March 18, 2024, Nvidia ($NVDA US) announced the launch of the Nvidia Quantum Cloud service for researchers and developers to test out their quantum-computing software across scientific domains such as chemistry, biology, and material science.

“NVIDIA Quantum Cloud breaks down the barriers to exploring this transformative technology and lets every scientist in the world harness the power of quantum computing and bring their ideas closer to reality”, said Tim Costa, director of HPC and quantum computing at NVIDIA [Nvidia Press Release, March 18, 2024].

As quantum computing enablers, such as Nvidia, shift tools to adopters, the growing ecosystem of global players will emerge to develop and commercialize quantum technologies. According to McKinsey & Company [The Quantum Technology Monitor, April 2023], the potential quantum technology market size will reach USD 106 billion by 2040.

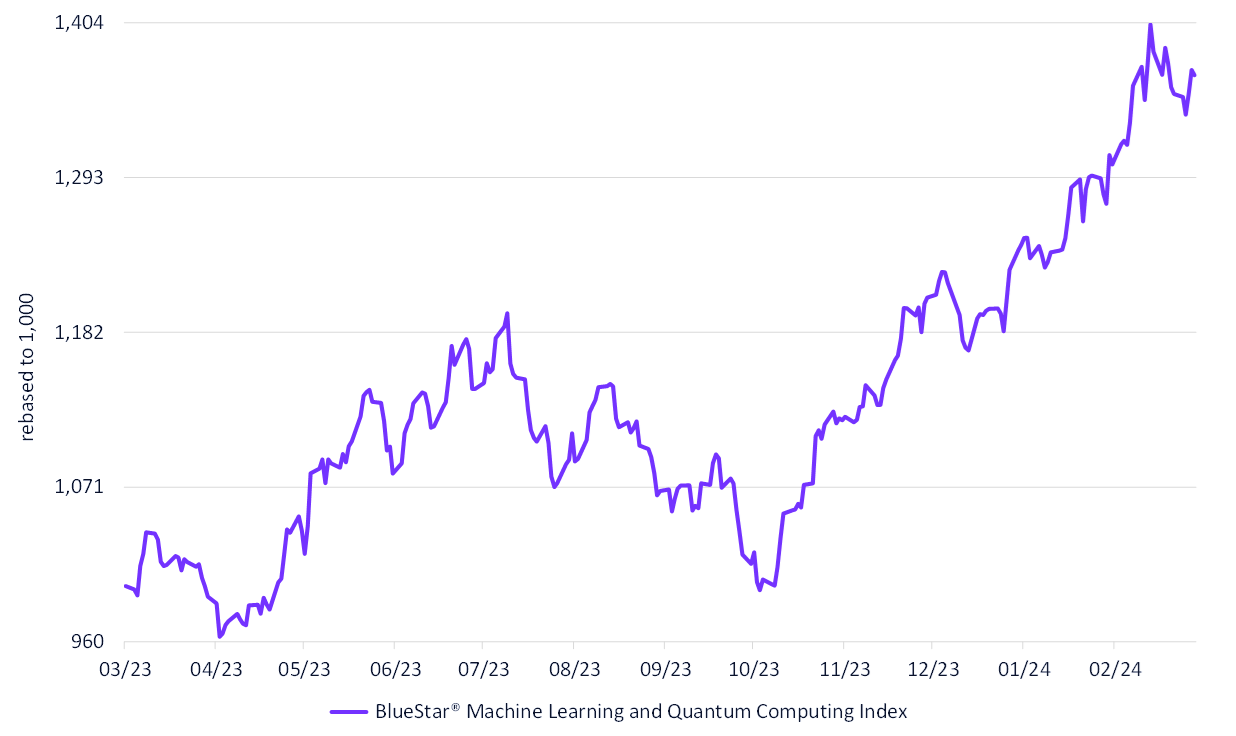

BlueStar® Machine Learning and Quantum Computing Index (BQTUM) tracks the performance of the largest and most liquid companies in the global quantum computing and machine learning industries. It continues to break its all-time highs, with one-year performance greater than 40%, ending March 24, 2024.

BlueStar® Machine Learning and Quantum Computing Index

3/24/2023-3/24/2024

Source: MarketVector IndexesTM. All values are rebased to 1,000. Data as of March 24, 2024.

For more information on our family of indexes, visit www.marketvector.com.

Joy Yang is the Head of Product Management and Marketing at MarketVector. She is responsible for managing MarketVector products and services to accelerate innovation in financial index design and adoption. Joy brings more than 25 years of investment experience to MarketVector, having led teams delivering index and quantitative-active investment solutions at Arabesque Asset Management, Dimensional Fund Advisors, Vanguard, Aberdeen Standard Investments, AXA Rosenberg, and Blackrock. She has an MBA from the University of Chicago Booth School of Business and a Bachelor of Science in Electrical Engineering from Cooper Union’s Albert Nerken School of Engineering.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.

Get the latest news & insights from MarketVector

Get the newsletterRelated: