The effect of the sanctions on Russia extended to its central bank, which lost access to a large portion of its foreign exchange reserves, as Western governments froze those assets in their joint efforts to pressure the country to stop the violent attacks on Ukraine. Effectively, at a critical time, the bank’s foreign currency reserves were rendered useless. This shifted the spotlight to gold, which the bank held in-country and, thanks to strong purchases in recent years, is estimated to represent just over 20% of its total reserves (approximately 2,300 tonnes; $140 billion).

Other central banks around the world were certainly watching, as gold, a lifeline, emerged uncontested as a safe store of value. To be clear, later in March, the U.S. did issue a notice prohibiting gold transactions with Russia. While this certainly complicates any sales, we doubt it will stop Russia from monetizing its gold if it so desires. The Bank of Russia later announced it will buy gold from Russian credit institutions.

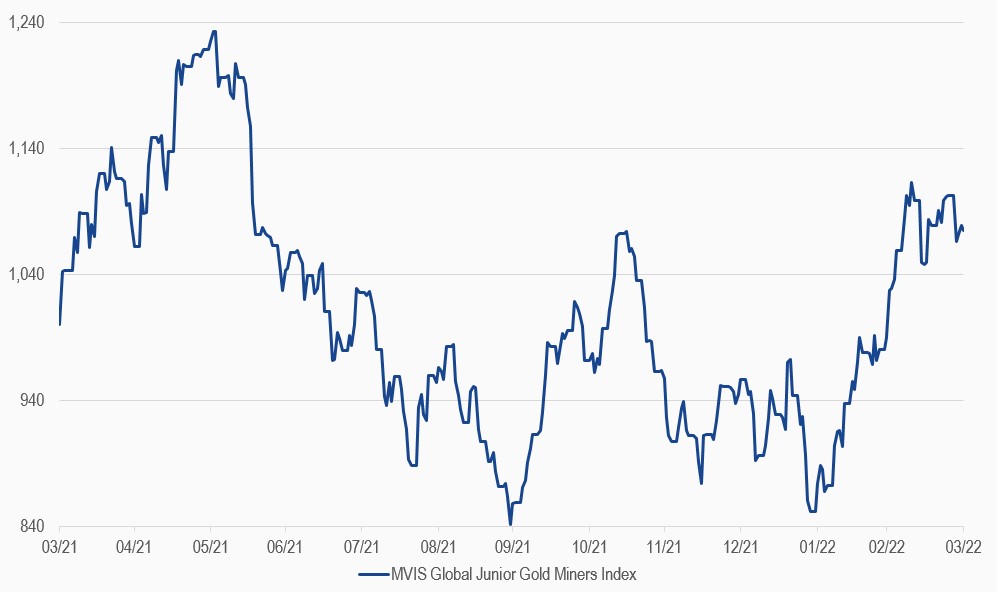

MVIS Global Junior Gold Miners Index

31/3/2021-31/3/2022

Source: MV Index Solutions. All values are rebased to 1,000. Data as of 31 March 2022.

Get the latest news & insights from MarketVector

Get the newsletterRelated: