The quest for energy independence among global governments propelled uranium prices to a 12-year high this September, reflecting a pronounced shift towards nuclear power in the wake of escalating gas prices due to Russia's invasion of Ukraine. This transition is further evidenced in the market dynamics, with major uranium miner Cameco reducing its U3O8 annual production by approximately 9%1, constricting supply and thereby ‘fueling’ the upward pressure on uranium prices. Given its low carbon emissions and high operational efficiencies, nuclear energy is well-positioned to play a crucial role in the future sustainable energy landscape.

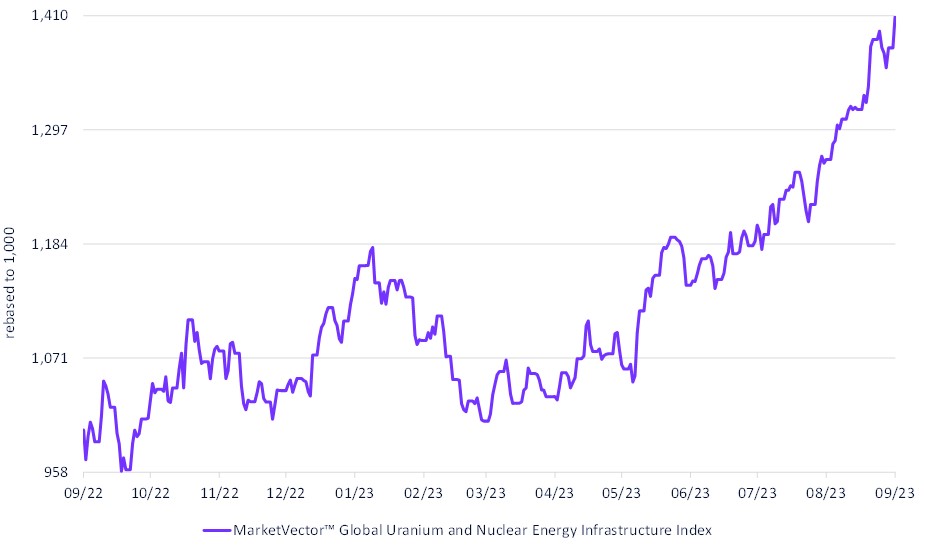

The MarketVectorTM Global Uranium and Nuclear Energy Infrastructure Index (MVNUCL) provides targeted exposure to companies operating in the global uranium and nuclear energy infrastructure sector. The index is up nearly 30% YTD, underscoring the market's recognition of nuclear energy’s potential as a key component in addressing energy security and environmental concerns.

MarketVectorTM Global Uranium and Nuclear Energy Infrastructure Index

9/25/2022-9/25/2023

Source: MarketVector IndexesTM. Data as of September 25, 2023.

1 World Nuclear News, September 4th, 2023. https://www.world-nuclear-news.org/Articles/Cameco-revises-2023-Canadian-production-forecast#:~:text=Cigar%20Lake%20is%20now%20expected,of%2015%20million%20pounds%20U3O8.

For more information on our family of indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Jesse Nacht is the Index Research Associate at MarketVector IndexesTM (“MarketVector”). His core responsibilities include assisting in index development and design. Having come from a trading background, Jesse holds a Series 57 Securities Trader License. He has a Master of Arts in International Economics and Finance from the International Business School at Brandeis University. Prior to this, he also received a Bachelor of Arts in Economics from the same university.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.