After a short-lived, CPI-fueled dump, crypto rallied impressively from the lows. The headline about a loose confirmation on the Merge's target date accelerated the positive momentum. In our last blog post, we’ve written about the misconceptions of this sophisticated project. It is undoubtedly one of the biggest events in crypto’s history and has the potential to bring outperformance to ETH.

According to Tim Beiko, who is an Ethereum protocol support engineer, the Merge may take place on the week of September 19. It’ll see Ethereum move from the energy-intensive Proof-of-Work consensus mechanism to a more efficient Proof-of-Stake system. While it’s not expected to reduce Ethereum's fees and slow transaction speeds, it will have a significant impact on the network's energy use.

The market is so excited because it’s expected that there will be a large supply sink post-merge due to the depreciation of PoW block subsidies and indefinitely locked validator rewards in conjunction with base fee burns. Not only will the total ETH supply become net deflationary, but liquid rewards earned by validators will be reduced from 15,135 ETH per day to 1,777 ETH per day. Validators also have far lower operating costs and a literal stake in the network, so it’s reasonable to assume these players are generally bullish on ETH.

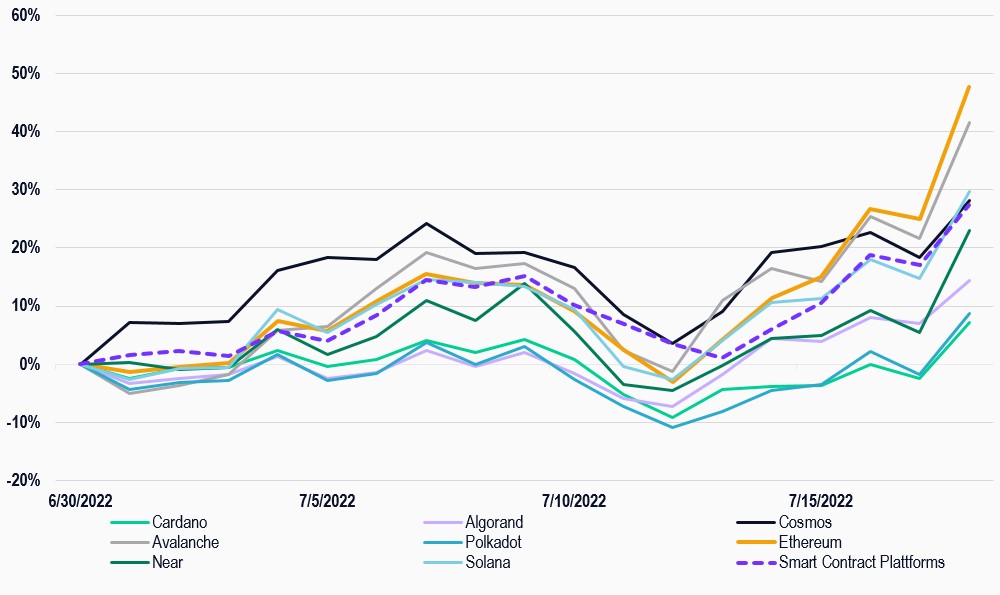

The following chart indicates how theses news impacted the whole smart contract category with Ethereum outperforming the rest of the coins. Notable other outliers to the upside are Cosmos and Avalanche. Polkadot and Cardano are the laggards. It’s a good sign that fundamental data have an impact again. The Merge has filled a narrative void, however Crypto has become a macro asset. It remains to be seen, if such news can impact the market sustainably. At least with the help of our MVIS® CryptoCompare Smart Contract Leaders index (ticker: MVSCLE), investors can easily discover, which coins are outperforming the market or not. A great help in a very volatile cycle we’re currently in.

Cumulative Performance of Smart Contract Coins and the MVIS® CryptoCompare Smart Contract Leaders

Source: MarketVector Indexes. All values are rebased to 100. Data as of July 18, 2022.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Martin Leinweber is an expert in fundamental and quantitative trading strategies. He sees cryptoassets as a fundamental building block for investors to achieve their return targets in a low interest rate environment. He works as a Digital Asset Product Strategist at MarketVector Indexes providing thought leadership in an emerging asset class. His role encompasses product development, research and the communication with the client base of MarketVector Indexes. Prior to joining MarketVector Indexes, he worked as a portfolio manager for equities, fixed income and alternative investments for almost two decades. He was responsible for the management of active funds for institutional investors such as insurance companies, pension funds and sovereign wealth funds at the leading German quantitative asset manager Quoniam. Previously, he held various positions at one of Germany's largest asset managers, MEAG, the asset manager of Munich Re and ERGO. Among other things, he contributed his expertise and international experience to the establishment of a joint venture with the largest Chinese insurance company PICC in Shanghai and Bejing. Martin Leinweber is co-author of „Asset-Allokation mit Kryptoassets. Das Handbuch“ (Wiley Finance, 2021). It’s the first handbook about integrating digital assets into traditional portfolios. He has a Master in Economics from the University of Hohenheim and is a CFA Charterholder.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. Inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.