We are constructive on the outlook of the gold price in 2024 and beyond. Gold seems to have established strong support around the USD 1,900 to USD 2,000 per Troy ounce level. This is especially remarkable when we consider that investment demand, as gauged by the holdings of gold bullion ETFs, has been persistently declining.

Daily, markets are trying to decide if a soft landing1 in the U.S. is still an option. We think we may be getting closer to a point where the U.S. and global economy start to slow down more significantly under the stress imposed by high interest rates and the strain of not one, but tragically now, two wars. These should lead to a drop in corporate earnings, followed by a correction of the equity markets a weaker jobs market, and a higher unemployment rate.

Inflation has eased, but it remains above the U.S. Federal Reserve’s 2% target and continues to impact businesses and households. There is a risk that bringing inflation back down to 2% could be a long process; historically that has been the case. We believe that when these risks become more visible to markets and even more likely to generate poor outcomes for the financial system, gold is positioned to benefit. In 2024, we see an opportunity for gold to test and break through the all-time highs of USD 2,075 an ounce in 2020 and USD 2,135 more recently, on 4th December.

Gold equities are positioned to benefit from sustained, record-high gold prices as investors look for leveraged, and diversified exposure to gold.

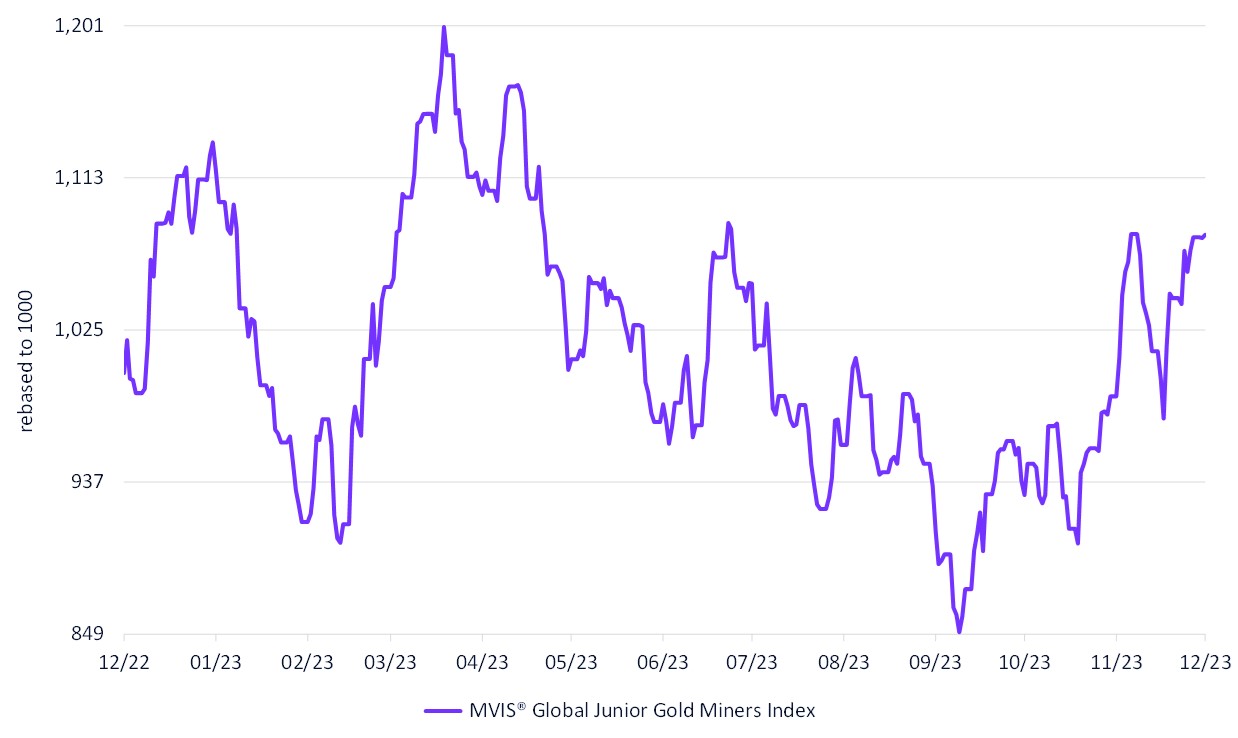

MVIS® Global Junior Gold Miners Index

12/26/2022-12/26/2023

Source: MarketVector IndexesTM. All values are rebased to 1,000. Data as of December 26, 2023.

Source1:Sort Landing: In economics, a soft landing is a cyclical slowdown in economic growth that avoids recession. (See https://www.investopedia.com/terms/s/softlanding.asp)

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Ima Casanova joined VanEck in 2011. Before VanEck, Ima was Managing Director and Senior Equity Research Analyst at McNicoll Lewis & Vlak and established the firm's metals and mining research department. Previously, she was an Equity Research Analyst at Barnard Jacobs Mellet USA and BMO Capital Markets and held positions as a Production Technologist, Offshore Wellsite Supervisor, and Petroleum Engineer for Shell Exploration and Production. Ima has both an MS and a BS (magna cum laude) in Mechanical Engineering from Case Western Reserve University.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements herein may constitute projections, forecasts, and other forward-looking statements that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. Including security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered investment advice.