A-REITs in Australia had a stellar 2014 and look set to continue to outperform in 2015 due to:

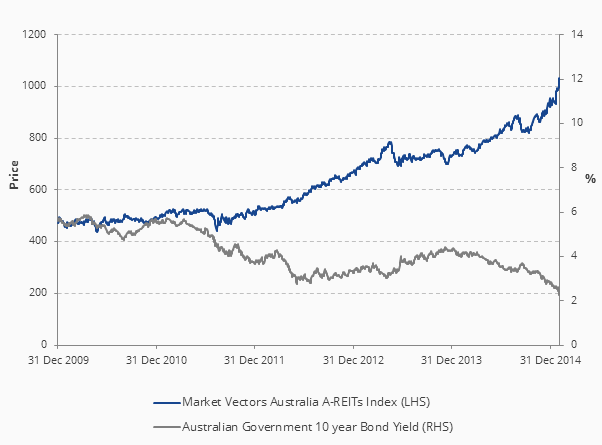

- This low interest rate environment has historically benefitted A-REITs which have been inversely correlated with the Australian 10 year Bond Yields.

Source: Bloomberg, Market Vectors, 31 December 2009 to 4 February 2015A-REITs yields remain well above the 10 year bond yield. Currently the spread differential is ~120bps above the long term average.

- Corporate activity in the sector continues as evidenced by the recent merger announcement of Novion Property Group (NVN) and Federation Centres (FDX).

- With positive cash flows and normalised gearing levels A-REITs will continue to pay income. This is primarily due to fixed rental increases and the long term nature of leases.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Arian Neiron is responsible for the strategy and day-to-day operations of VanEck’s Australian business. Prior to joining VanEck, Arian was a partner at boutique consulting firm Sunstone Partners, specialising in Asset and Wealth Management. Previously Arian worked for Perpetual as Senior Portfolio Specialist; Head of Product Development for Protected Investments; and Senior Product Manager for Platforms and Wholesale Funds. Arian has also held positions at Credit Suisse and MLC. Arian has a Bachelor of Commerce from Curtin University and a Diploma of Financial Services and is currently undertaking an MBA at Macquarie Graduate School of Management (MGSM).

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.