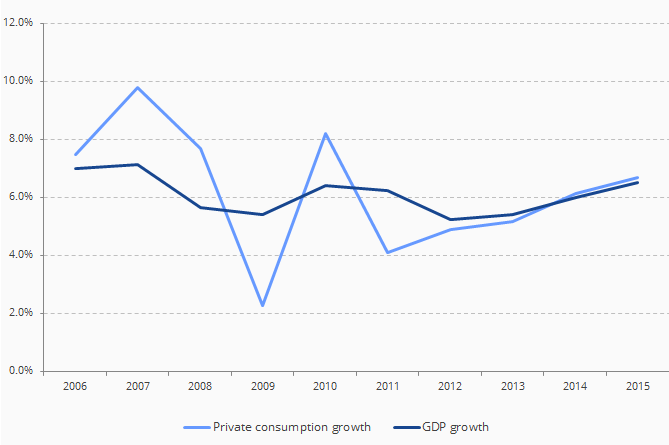

In 2015, Vietnam is expected to exhibit better GDP growth of 6.5% YoY (thanks to private consumption growth), as economic restructuring from 2012 begins to deliver fruitful results, with macro stability ensured (low inflation, bad debt to 3%, stable VND – relatively to its peers). This might ultimately translate into sovereign credit rating upgrade, closer to investment grade. For its stock market, valuation remains cheap (2015 Price to Earnings ratio at 12.39x) and the new wave of state-owned enterprises’ IPOs could engulf the market with more sound investment opportunities, and quality stocks under the new regulation which requires a faster listing process.

Vietnam GDP & private consumption growth 2006-2015 (Source: CEIC, SSI Research)

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Ms. Phuong Hoang joined SSI Research & Investment Advisory at the beginning of 2007, and her involvement has awarded her with 8 years of experiences and insights into the Vietnamese Stock Market. Sectors under her coverage included conglomerates, steel, pharmaceuticals, oil & gas and she is currently spearheading equity strategy. Ms. Phuong Hoang was made Head of Institutional Research and Investment Advisory in 2011. In 2013 & 2014, she was awarded with the Best Country Analyst and Best Strategist-Vietnam and under her leadership, SSI Research took home the major award categories in the highly publicized Asiamoney Brokers Poll 2013 & 2014, including Best Country Research-Vietnam.

Prior to joining SSI, Ms. Phuong spent 4 years at the Dutch Embassy in Vietnam, where she provided investment advisory to Dutch companies and organizations that invest in Vietnam and another 2 years in the transportation sector.

Ms. Phuong obtained a MSc in Information Management & Finance from the University of Westminster, UK, and underwent an intensive training regimen at Daiwa Capital Market’s Institute of Research in Hong Kong in 2008.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.