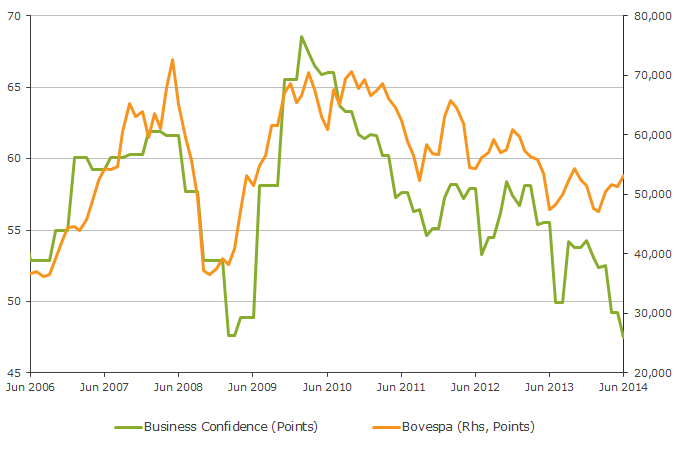

Business confidence in Brazil has reached multi-year lows due to political uncertainty, structural headwinds regarding production bottlenecks, and a poor commodity price outlook.

Moreover, the index has dropped to GFC levels, which is a reflection of Rousseff's popularity among Brazilian and international investors, given that, even though this giant economy has fallen short of expectations, macroeconomic figures do not paint a recessional picture.

Business Confidence vs. Bovespa Index

Source: Bloomberg, BICE Inversiones

All the same, Brazilian companies have been witnessing shrinking profits for some time now, which ultimately have translated in a Bovespa underperformance in comparison with other relevant emerging markets. Therefore, Dilma, in a last effort to improve her popularity, has come up with a full-measure package aiming to support Brazilian corporate sector. This, in my view, has the potential to boost investors´ confidence regarding Brazilian assets and governability, which, after several years of under-performance, could put the commodity giant under international investors' radar once again.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Mr. Camilo Larrain is a Senior Analyst of Strategy at BICE Inversiones, a Chilean investment firm located in Santiago. Mr. Larrain has specialized during his entire career in Asset Allocation and international portfolio recommendations from his previous job, at Banco Penta, to his actual one. He holds a BA degree in Economics from Universidad de Chile.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.