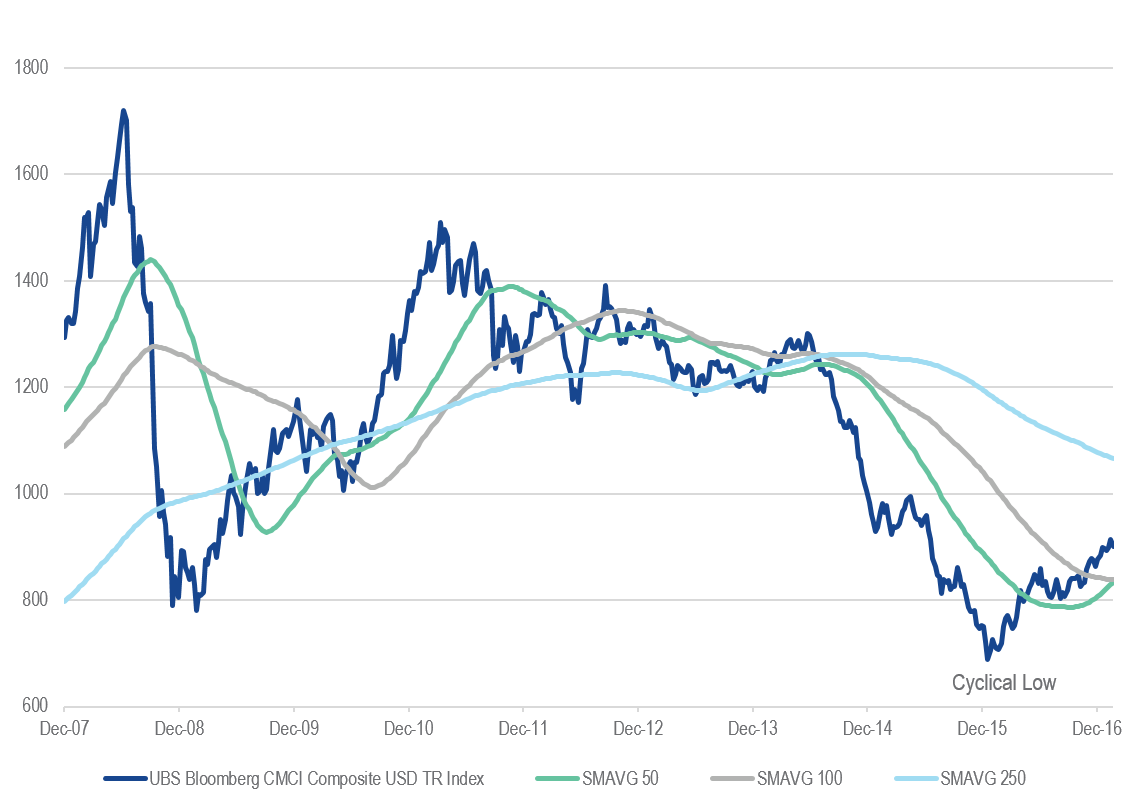

2016 was an important turning point for the natural resources space and commodities in general. We believe the first quarter of the year marked an important cyclical low for natural resources and the commodities sectors.

As we go into 2017, we think the positive trends in most commodities markets will continue, not least because of the huge reduction in future supply we’ve experienced over the past several years. The narrative has been one of a significant reduction in investment and production across commodities, such as energy, and some of the important diversified metals — copper in particular.

We think 2016 marked the first year in what could be a multi-year cyclical positive trend for the natural resources and commodities sectors.

UBS Bloomberg CMCI Composite TR Index

Source: Bloomberg, data as of 20.02.2017

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Roland Morris joined VanEck in 2012 and is Portfolio Manager and Strategist for the firm’s Commodities Strategy. Prior to joining VanEck, Mr. Morris spent thirty years in the financial services industry as a macro/commodities trading specialist; manager of futures clearing and execution services; and client relationship management. He holds a BA in economics from the University of Vermont.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.