After three years of political and economic unrest, a promising environment has emerged increasing recovery hopes. A new and overwhelmingly accepted Constitution by Egyptians in January 2014, followed by a majority win for the newly elected President Al Sisi in June 2014; besides Parliamentary elections will be concluded in the next few months, which will complete the Road Map set in July 2013.

On the economic front, Gulf Arab States including Saudi Arabia, Kuwait and UAE pledged around USD 15 billion to support Egypt's economy since July 2013. Recently, Saudi Arabia encouraged having an international donors conference in November 2014 to further enhance the Egyptian economy.

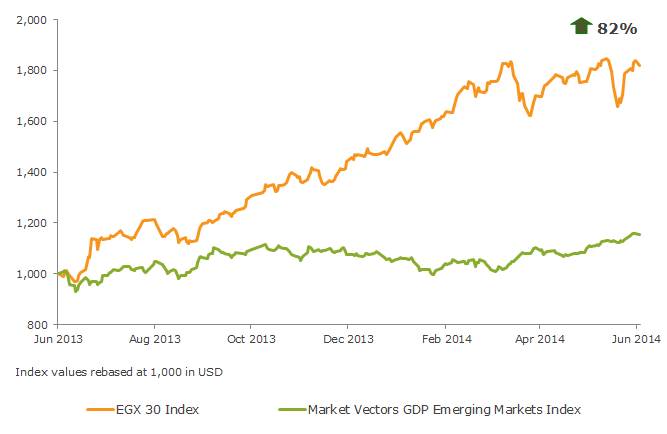

All these factors reflected positively on Egypt's capital market and increased investors' confidence. Market liquidity on an average daily basis exceeded LE 1 billion in the first six months of 2014; five times more compared to the first half of 2013 and the Egyptian Stock Market was ranked as one of the best performing markets in 2014, according to the Economist.

Egyptian Exchange 30 Index (EGX 30)

(13 June 2013 - 15 June 2014)

Data as of 15 June 2014.

Source: Bloomberg, MVIS

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Professor Mohammed Omran is the Chairman of the Egyptian Exchange and a Professor of Finance at the Arab Academy for Science and Technology. He served several years as an Economist at both the Arab Monetary Fund and the International Monetary Fund and was an advisor to the Minister of Investment and an acting Executive Director of the Egyptian Institute of Directors. Professor Omran holds an MSc from Cairo University and Ph.D. in Finance from the University of Plymouth. He is a renowned author whose work appears in several international Economic and Finance journals and publications.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.