When Narendra Modi was swept to power as India’s prime minister in May 2014, all the talk was of swift reform and economic revitalization. Some 20 months, and more, later, the talk now concerns what has happened to these reforms.

In a country as populous as India, with so many «stakeholders», reforms tend to need to be fundamental to be effective. Two reasons, perhaps, for the challenges Mr Modi currently faces. Instituting change at the state-owned banks constitutes one of these fundamental reforms. Such change will, not least, include full recognition of the problem of bad debts.

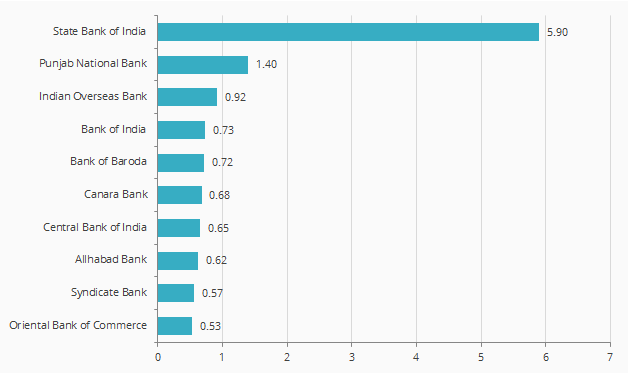

Between 2013 and 2015, 29 state-owned Indian banks wrote off Rs 1.14 trillion (USD 16.77 billion), considerably more than they had done in the preceding nine years.

A fundamentally healthy banking system would provide Mr Modi with the solid base he needs for economic revitalization.Bad Debts Written Off in 2013-2015

10 Top State-Owned Banks (USD Billion)

Source: The Indian Express, Reserve Bank of India

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Angus Shillington is a Deputy Portfolio Manager at VanEck. Prior to joining VanEck, headed International Equity for ABN AMRO; responsible for Asian and European equity cash and derivative distribution to North American institutions.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.