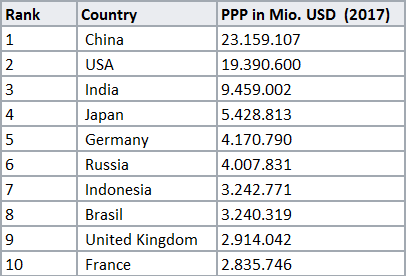

The Indonesian stock market plays only a minor role in emerging market indices. Surprisingly, however, in terms of purchasing power parity (PPP), the country ranks 7th globally, ahead of Great Britain and France1.

Source: IMF Report for Selected Countries and Subjects, January 2018

At 29% of GDP, the government debt ratio is low2 and the population of 266 million people is comparatively young - good starting conditions for long-term growth. The IMF forecasts real growth of over 5 percent for 2018.

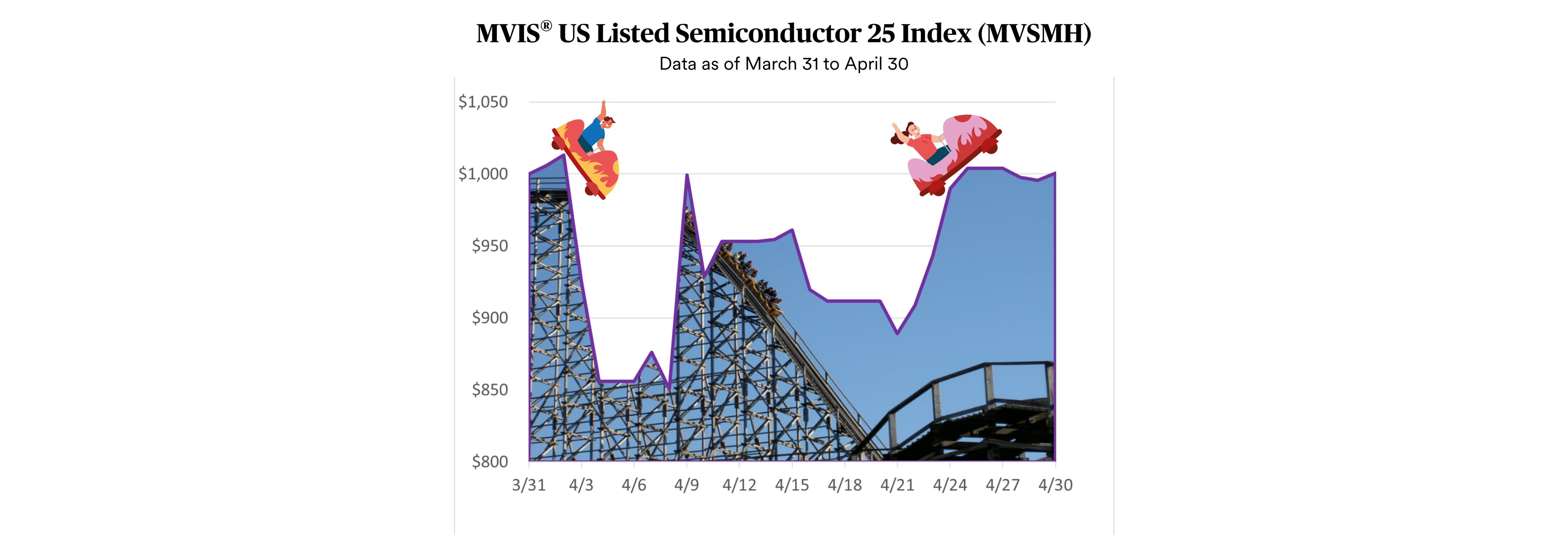

The stock market is dominated by financial stocks and former state-owned companies, which can be associated with high volatility. The current downward trend contrasts with expectations for economic growth.

One-Year Performance MVIS Indonesia

Source: MV Index Solutions

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Jan Altmann is consultant and contributor to the investment and Fintech industry. He has been instrumental in setting up the ETF business in Europe and worked for many big names as well as small boutiques since then. He provides advice and content about emerging topics like ETF-Investing, digitisation, distribution and industry standards.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.

Sources:

1IMF Estimate for 2017, database 2016

https://en.wikipedia.org/wiki/List_of_IMF_ranked_countries_by_GDP2IMF Report for Selected Countries and Subjects

http://www.imf.org/en/Publications/WEO/Issues/2018/01/11/world-economic-outlook-update-january-20183Credit Suisse World Wealth Report 2017

http://www.imf.org/en/Publications/CR/Issues/2018/02/06/Indonesia-Selected-Issues-45615