How Expanding Diplomatic Horizons supports Israeli Resilience in Uncertain Times

June 2022

As the US economy and technology sector struggles amidst the fears of inflation and rising interest rates, financial contagion is impacting global equity and bond markets around the world.

Israel, a member of the OECD ‘Developed Market club’ since 2010, has not been immune. The BlueStar® Israel Global Index (BIGI®) which tracks Israeli companies, across all sectors of the economy, irrespective of their listing venue is down ~24% YTD, in line with the S&P500.

And similar to the US, Israel is a hub of innovation and technology. In fact, 31 of the 111 BIGI® component (or approximately 40% by weight) are in the Information Technology sector.

The dynamic Israel Tech Sector, as defined by the BlueStar® Israel Global Technology Index (BIGITech®), is down approximately 33% YTD – slightly worse than the Nasdaq 100 index, down 31%, and the -29.4% performance of the S&P Global 1200 Information Technology Index.

However, on a longer-timeframe, Israel’s relative performance still stands out above that of most Developed Markets.

(See Chart below comparing BIGI® and BIGITech® to the MSCI EAFE index of Developed Markets outside of North America.)

BlueStar® Israel Global Index, BlueStar® Israel Global Technology Index and MSCI EAFE Index

31/12/2011-17/06/2022

Continual Evolution of Sectoral Weights in the Comprehensive BlueStar® Israel Global Index

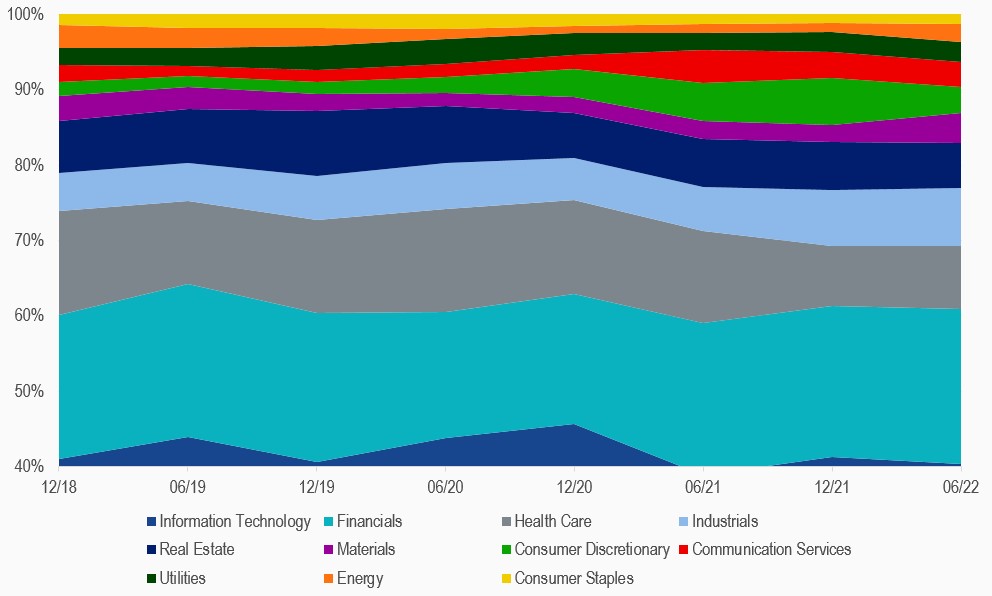

Even though Israeli Technology has tended to get the most attention over the past few years, one can note the sectoral shift away from tech since its high in late-2020, and the subsequent increase in the weight of financials, industrials and materials below:

From a long-term perspective, this sector graphic highlights the importance of a broad, deep and complete allocation to the dynamic Israeli private sector, especially as new trade and investment relationships for Israel open up worldwide.

Market Performance versus Economic and Geopolitical Fundamentals

Despite the bearish trend of since the start of 2022, when you look under the hood, the foundational elements of Israel and thus Israeli Tech ecosystem continue to improve. These tectonic shifts tell a very different story and offer investors an alternative to the ‘doom and gloom’ of the US.

How significant are the shifting geopolitical and economic horizons for Israel? Groundbreaking.

1. Slow but steady improvement in Saudi Arabian-Israeli relations

Once a glaring tension point in Arab/Israeli regional politics, now has a high probability of de facto steps toward normalization next month, including a likely aviation accord, R&D cooperation agreement and investment plans for medicine, agriculture and energy.

Further, major business and investment deals are currently underway between two countries, signaling a new era of regional trade and prosperity – one that will grow significantly almost overnight once relations are formally established.

2. United Arab Emirates (UAE) relations

Israel is beginning to experience the benefits and the Abraham Accords, a series of treaties normalizing diplomatic relations between Israel, the UAE, Bahrain, Sudan, and Morocco, facilitated by the U.S. Administration in late 2020.

As it’s evolved, we’ve seen a historic UAE-Israel Free Trade Agreement signed, with UAE-Israel trade expected to exceed $2 billion in 2022. Furthermore, the economic ties between the UAE and Israel have had a profound impact on both countries’ technology and innovation ecosystems, with joint-ventures flourishing, as well as strategic investment in a wide range of industries, including clean energy, AgriTech, and cybersecurity.

3. Steady growth of economic ties with other Abraham Accord countries, as well as with Egypt and Jordan

Less headline-grabbing, but equally significant, has been the slow but steady growth of economic cooperation between Israel and Morocco, and even more significantly, with Egypt and Jordan. Israel and Morocco signed a trade and investment cooperation agreement in February, with both countries aiming to expand annual trade volume to $500 million/year from the current $140 million. With Egypt, Israel has agreed to increase R&D cooperation and to develop a commercial crossing point at Nitzana in the Negev desert, and to increase annual trade (excluding tourism and energy) to more than $700 million/year. In early 2020, Israeli and Egyptian companies signed ten-year Natural Gas contract worth $15 billion. Furthermore the major new Natural Gas partnership between Israel, Egypt and the European Union has potential for trade flows with a value of more than one billion dollars/year.

Finally, with Jordan, Israel has expanded a major water provision deal, and agreed to increase exports from Jordan to the Palestinian territories more than four-fold, from $160 million to $700 million in 2023 and beyond. There is also substantial tourism cooperation between Jordan and Israel.

4. Israel’s economic horizons continue to expand beyond the Middle East

India: As regional peace amplifies, we see the impact on the growth of trade, investments, and strategic ties around the work, most notably in India, Israel’s third-largest Asian trade partner, where the countries enjoy an extensive and comprehensive economic, military, and political relationship.

The US announced the concept of a “I2U2” Summit this month, with the planned first meeting planned for July. This initiative will further solidify economic cooperation linking Israel, India, the UAE and US, with the objective of a more stable region and increased long-term security and prosperity.

South Korea: Israel signed its first Free Trade Agreement (FTA) in Asia with South Korea in May of this year – South Korea is the world’s 12th largest economy and Israel’s third largest trade partner. The FTA will not only have an immediate benefit to Israeli auto buyers, with tariffs on very popular Korean vehicles to be eliminated, as well as tariffs on semiconductors and other electronic equipment, but the possibilities of further collaborations between two of world’s most innovative nations is endless.

Vietnam/China: Also, ‘over the horizon,’ there is strong likelihood’ of FTA with Vietnam by H1 2023, and progress is anticipated for a FTA with China, although geopolitics and concerns from the US might slow it down.

4. The local Israeli economy and resilience of key Israeli sectors:

Israel’s macroeconomic fundamentals are dichotomous, after posting surging GDP figures for 2021, the Israeli economy contracted 1.9% during Q1 2022. Yet at the same time, the Israeli government’s budget is now in an unprecedented fiscal surplus. And while tech investment and funding has slowed, it has retracted much less than anticipated in 2022 YTD. Further, the Israeli Real Estate market remains robust, despite tech’s slowdown.

Aligned with this trend, OECD still projects strong full-year Israeli GDP growth of 4.8% in 2022 and 3.4% in 2023, but at the same time it cut its global forecast for 2022, to 3% for 2022 and 2.8% for 2023.

Israeli energy exports and investment have blossomed, providing a new source for the much in-demand Eastern Mediterranean Natural Gas, culminating with an EU-Egypt-Israel agreement to develop production and supply from the Eastern Mediterranean to Europe (to replace Russian Gas).

In addition, the Israeli Citizen’s Fund, Israel’s long-awaited Sovereign Wealth Fund (SWF) – which invests government tax revenue from Israel’s major offshore energy resources – was finally launched this month.4The fund was launched with NIS 1.14 billion, a relatively small amount, but the Citizen’s Fund is expected to grow to more than NIS 140 billion by 2050.

Finally, on June 20th, Israeli PM Naftali Bennett and Foreign Minister Yair Lapid announced their intention to disband the coalition government, which will likely lead to new elections this autumn. The shift to another election campaign – Israel’s fifth since 2019 – will add political uncertainly into the Israeli economy, but we do not expect any major changes in economic policy.

For more information on MarketVector Indexes’s coverage of the Israel economy and the BIGI® & BIGITech® Indexes, sign up for our quarterly Israel Equity Review and Outlook.

Q2 2022, published on 5 May 2022 can be found here.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Steven Schoenfeld joined MarketVector Indexes as CEO following its acquisition of BlueStar Indexes in August of 2020. Steven was the Founder and Chief Investment Officer of BlueStar which maintained a family of indexes for Global Technology Stocks, Emerging Markets and Israeli Equities and Bonds. Steven is a 36-year veteran of the investment management industry, having served in senior fiduciary positions at Northern Trust, where he oversaw more $300 billion in quantitatively-managed global equity and fixed income portfolios, and at Barclays Global Investors (now Blackrock), where he managed more than $70 billion in developed and emerging market stock index fund and ETFs. Previously, he led the team at the IFC/World Bank which developed the first investable Emerging Market indexes, and traded Japanese stock index futures on the floor of the Singapore Exchange.

Steven is the author of Active Index Investing (Wiley Finance, 2004), co-author of The Pacific-Rim Futures and Options Markets (McGraw-Hill, 1992), and co-founder of IndexUniverse.com (now ETF.com). He has a BA in History and Government from Clark University, was a Fulbright Scholar in Economics at the National University of Singapore, and has an MA from the Johns Hopkins School of Advanced International Studies (SAIS).

Joe Levin joined MarketVector Indexes as Global Head of Business Development & Strategy following its acquisition of BlueStar Indexes in August of 2020. Joe was Partner and Chief Investment Strategist at BlueStar where he led the firm's engagement with institutional investors and its partnerships with wealth managers and advisors to guide their allocations to Israeli investments. Prior to joining the firm in 2016, he served for six years as the Chief Development Officer at the SF-based Jewish Community Federation and Endowment Fund, leading the organization’s coordinated annual, endowment, and legacy philanthropic resources development efforts. Joe has over 20 years of experience in investment and philanthropic planning, most notably as a Vice President at Bernstein Global Wealth Management (AllianceBernstein), where he advised wealthy individuals and organizations in all aspects of financial planning and portfolio construction.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. Inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.