Mortgage REITs are still waiting with bated breath for the impending increase in the target Federal Funds rate. Although the first rate hike continues to be pushed off, it is really just a question of when and not if at this juncture. Consequently, the risk of higher rates has not abated.

Mortgage REITs will face a more challenging environment as their net interest margin could come under pressure if short-term interest rates increase faster than longer-term interest rates. This would reduce profitability and, ceteris paribus, put downward pressure on mortgage REIT earnings and share prices.

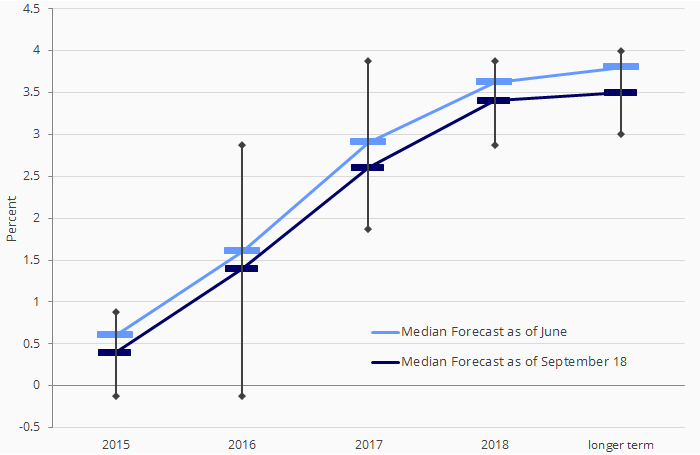

High, Low and Median Federal Open Market Committee (FOMC) Range

for the Targeted Fed Funds Rate

Source: Federal Reserve, REIS

About the Authors:

Victor Calanog and Ryan Severino are heading the economics and research department at Reis. They are responsible for the firm’s forecasting, analytics, and consulting and advisory services. They have a combined 27 years of professional and academic experience and can be found teaching classes at The Wharton School and Columbia University in their spare time.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.

Get the latest news & insights from MarketVector

Get the newsletterRelated: