2022 has been a tough ride for investors. YTD, equities, bonds, digital assets have all returned negative performance – swept under the waves by rising interest rates, record inflation, and poor economic growth. Bonds which usually are negatively correlated to stocks, providing protection in down markets, are now also sinking with markets.

A quick way to review returns across indexes, is to use the MarketVector Index Performance Tool, available for MVIS® and BlueStar Indexes, under the Tools menu, here.

A quick selection of our Sector/Thematic Indexes, show most of the equity indexes in red (negative returns), in line with broad market equity indexes.

Exhibit: Performance Tool (mvis-indices.com\index-performance)

Source: www.mvis-indices.com (as of 25 May 2022)

One area that has stood out in the sea of red, are the MarketVector Hard Asset Indexes. These equity indexes benchmark returns to hard assets using publicly listed liquid stocks.

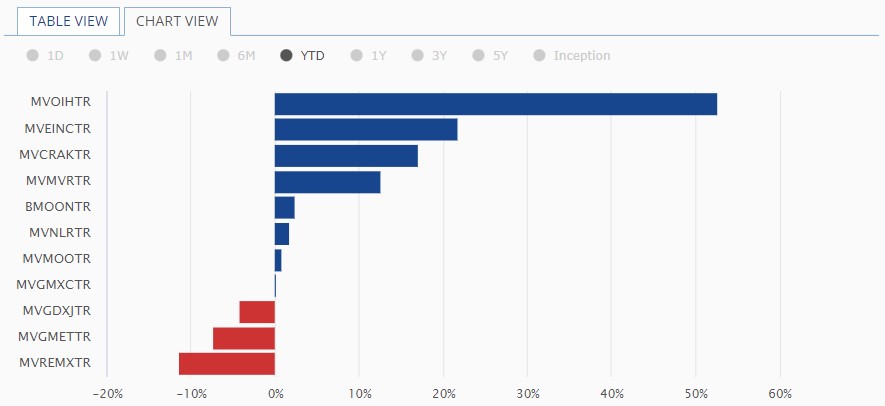

Exhibit: MarketVector Hard Asset Indexes

Source: www.mvis-indices.com (as of 25 May 2022)

YTD ending May 25 2022, MVIS® US Listed Oil Services 25 Index (ticker: MVOIHTR) returned +45% USD. Other indexes under the MarketVector Hard Asset Index family that returned positive performance YTD include: MVIS® North America Energy Infrastructure Index (ticker: MVEINCTR) +21% USD, MVIS® Global Oil Refiners Index (ticker: MVCRAKTR) 16% USD, MVIS® Australia Resources Index (ticker: MVMVRTR) 12% USD.

For more information on our family of indexes, visit: www.mvis-indices.com

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Joy Yang is Global Head of Index Product Management at MarketVector Indexes. She is responsible for managing MarketVector Indexes products and services to accelerate innovation in financial index design and adoption. Joy brings more than 25 years of investment experience to MarketVector Indexes, having led teams delivering index and quantitative-active investment solutions at Arabesque Asset Management, Dimensional Fund Advisors, Vanguard, Aberdeen Standard Investments, AXA Rosenberg, and Blackrock. Joy has an MBA from the University of Chicago Booth School of Business, and a BS in Electrical Engineering from Cooper Union’s Albert Nerken School of Engineering.

The article above is the opinion of the author and does not necessarily reflect the opinion of MarketVector Indexes or its affiliates.