December 2014

By Victor Calanog and Ryan Severino, Heads of Economics and Research, Reis

While recent yields on mortgage REITs have been attractive, they face two significant challenges in the near future. First, several components of Basel III will go into effect in January 2015. Among these are higher capital standards. These could impact the REPO market through higher costs and reduced liquidity. The REPO market is an important source of capital for mortgage REITs, which means that their funding costs could rise.

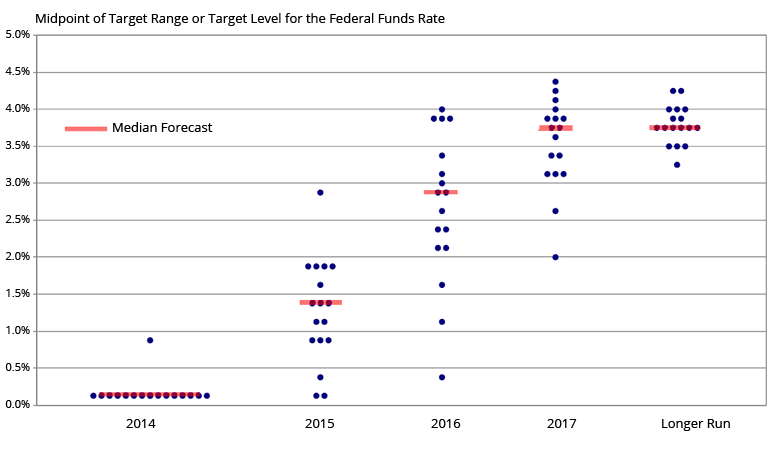

Second, and more significantly, interest rates may rise as soon as 2015. With short-term rates likely rising faster than long-term rates, this could cause mortgage REIT’s net interest margin to compress.

Federal Reserve Interest Rate Expectations

Source: Federal Reserve, Reis

About the Authors:

Victor Calanog and Ryan Severino are heading the economics and research department at Reis. They are responsible for the firm’s forecasting, analytics, and consulting and advisory services. They have a combined 27 years of professional and academic experience and can be found teaching classes at The Wharton School and Columbia University in their spare time.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.

Get the latest news & insights from MarketVector

Get the newsletterRelated: