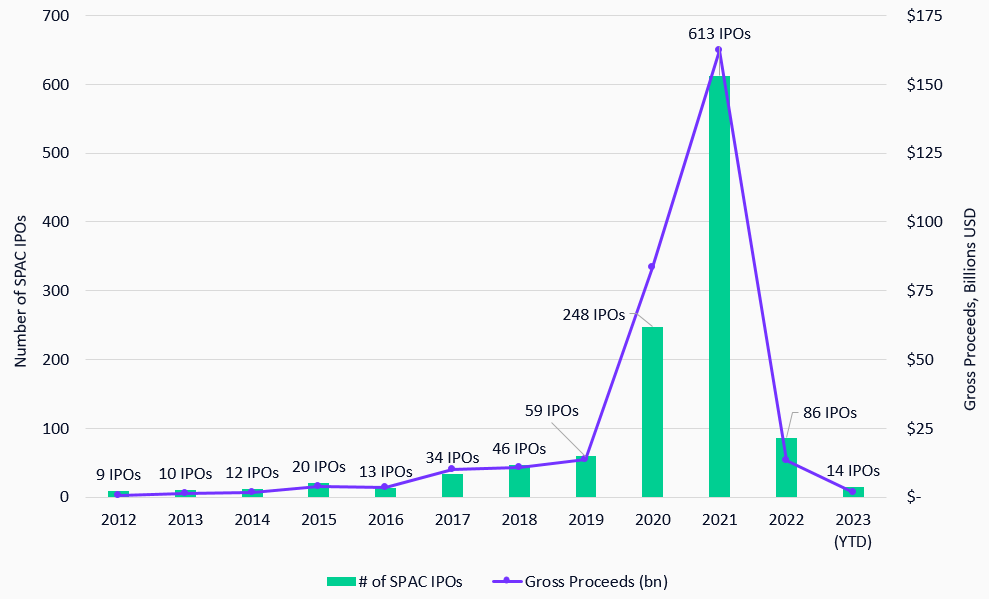

Once red-hot, the Special Purpose Acquisition Company (SPAC) market has significantly cooled. After a phenomenal run in 2021 with a record 613 SPAC IPOs raising gross proceeds of USD 162.5 billion, we've witnessed a stark decline. The number dropped dramatically to 86 IPOs with USD13.4 billion generated in 2022, and this downward trend has persisted into 2023 with only 14 SPAC IPOs so far this year, raising USD1.5 billion.1

This sharp fall-off can largely be attributed to the U.S. Securities and Exchange Commission (SEC) expanding its oversight and launching investigations into SPAC activities. Concerns about potential overvaluation, conflicts of interest, and the rush for private companies to go public have led to increasing scrutiny of these "blank check" companies. This increased regulatory pressure has, in part, caused a dampening of investor enthusiasm and a deceleration in SPAC activity.

Also worth noting is the high turnover rate among SPACs. Of the 1340 SPACs in existence, 322 have been liquidated. This liquidation rate of 24% is significantly high, reflecting the volatile and often risky nature of SPAC investing. Among the most prominent SPACs, Digital World Acquisition (DWAC) made headlines when it received a delisting notice from NASDAQ related to missed payments on dues. While reports indicate that the company plans to file an appeal, there is still skepticism about when or if the underlying merger will complete.2

Despite recent turbulence, SPACs can offer a unique avenue for companies driven by emerging trends and disruptive technologies. In this sense, they share a common thread with thematics in their pursuit of distinctive investment opportunities driven by shifts in transformative industries. Even still, investors need to conduct thorough due diligence and carefully assess the long-term viability and potential risks associated with SPAC mergers within their chosen thematic areas, considering the recent challenges and performance variations observed in the SPAC market.

Number of SPAC IPOs and Funds Raised since 2012, USD Billions

Source: Statista. (2023). A number of special purpose acquisition company (SPAC) IPOs in the United States from 2003 to May 2023. Retrieved May 23, 2023. https://www.statista.com/statistics/1178249/spac-ipo-usa/

Endnotes:

1Statista. (2023). A number of special purpose acquisition company (SPAC) IPOs in the United States from 2003 to May 2023. Retrieved May 23, 2023. https://www.statista.com/statistics/1178249/spac-ipo-usa/

2Kenwell, B. (2023). DWAC Stock Hits New 52-Week Low Amid Delisting Drama. Retrieved May 18, 2023. https://investorplace.com/2023/03/dwac-stock-hits-new-52-week-low-amid-delisting-drama/

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Jesse Nacht is an Index Research Associate at MarketVector Indexes GmbH. Jesse’s core responsibilities include assisting in designing and analyzing the development of MarketVector. He holds a FINRA Series 57 Securities Trader License having come from a trading background. Jesse has an MA in Economics and Finance from Brandeis University’s International Business School and a BA in Economics from Brandeis University.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, which do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.