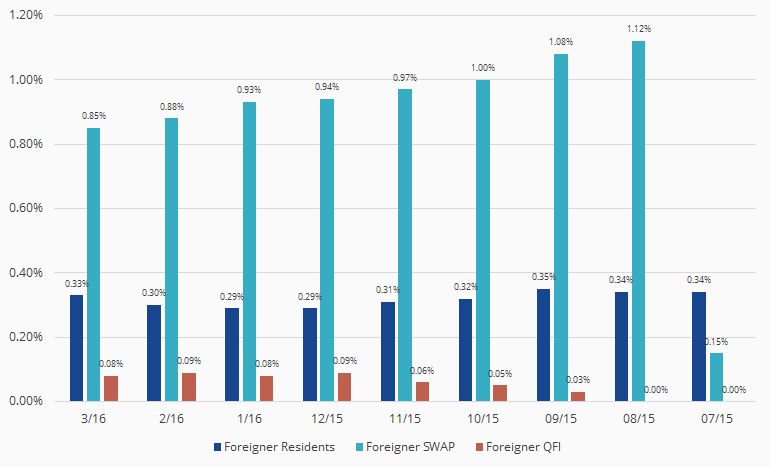

In an attempt to make itself more attractive to foreign investors, the Saudi Stock Exchange, or Tadawul, recently announced some significant future changes (slated for the first half of 2017) to its regulations. Since opening up to qualified foreign investors (QFIs), there has been neither a rapid nor large increase in either trading volume or share ownership on their part.

Furthering a desire (and, probably, the need) to increase qualified foreign participation in the market, these reforms include:

- The elimination of the limits on both the maximum foreign share ownership of any one company and of the market as a whole – 20% and 10% respectively.

- For each foreign investor, an increased limit of, now, 10% (up from 5%), on ownership «of the shares outstanding of a single issuer».

The limit of 49% on the aggregate foreign share ownership of any one company, however, remains. Seen in the light of Saudi Aramco's possible listing and the country's desire to reduce its economy's dependence on hydrocarbons, the proposed rule changes look potentially promising.

Tadawul Participation: Stock Market Ownership (% Value)

Note: QFI = Qualified Foreign Investor. Data as of month end.

Source: Saudi Stock Exchange (Tadawul)

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Thomas Butcher is an independent writer, researcher and consultant focusing, amongst other things, on strategic materials, in particular metals. With 37 years of experience in the financial world, he has lectured and spoken at conferences around the world. Amongst other things, he writes the «Letter from North America» in the Minor Metals Trade Association's bi-monthly publication The Crucible, and was lead author of the chapter on gallium (used in semiconductors) in the British Geological Survey's Critical Metals Handbook.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.