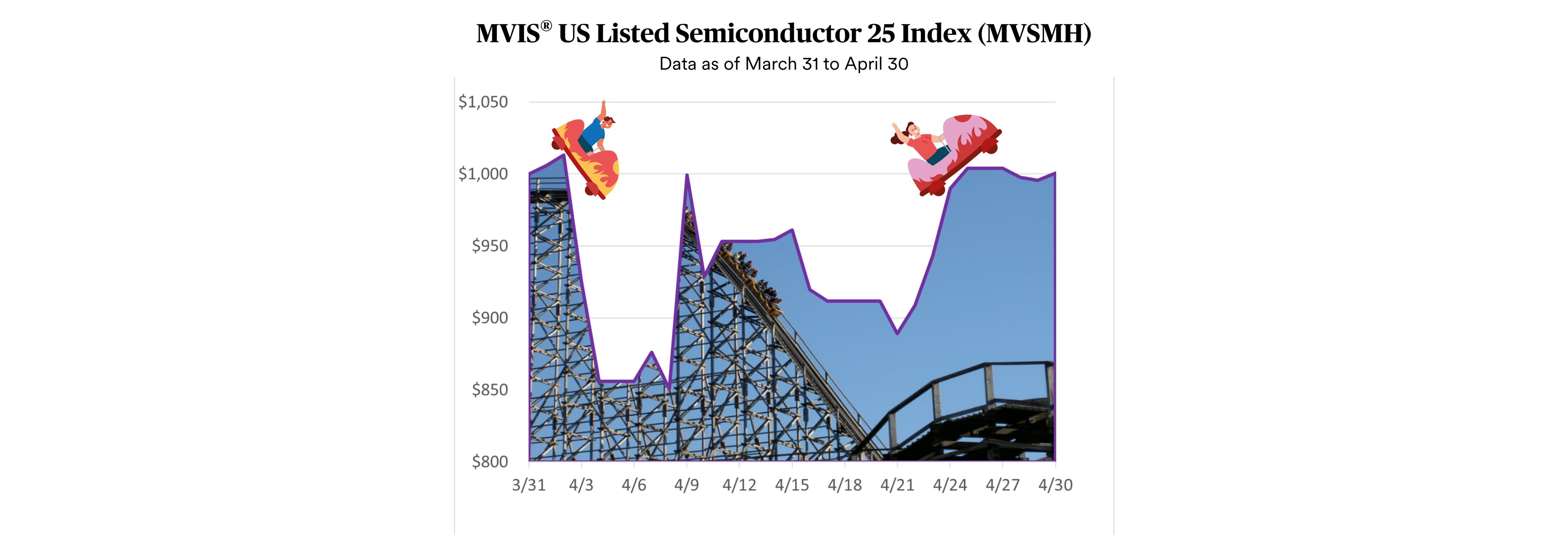

2020 marked the year the term “paradigm shift” suddenly became a part of our everyday speech. The world collectively witnessed radical shifts away from established norms to new ways of thinking across belief systems: the global acceptance of Climate Change, the acceptance of working from home and the acceleration of Thematic Investing.

The disruptions of Covid-19 forced us to rethink long-held assumptions and behaviors about the environment, business models and social standards. What has emerged is a dynamic shift in investor preferences, capital markets and opportunities for investors to allocate capital. Aligned with this has come the rise of thematic investing focused on emerging investment paradigms based on forward-looking growth.

Themes such as e-healthcare, e-Sports, and e-commerce amongst others -- accelerated directly or indirectly by Covid-19, differentiated themselves from their peers in traditional sector classifications – such as healthcare, entertainment, and retail amongst others.

For a detailed understanding of how MVIS thinks about building thematic indices, please refer to our MVIS Insight Paper: “Shifting Paradigms: Looking Beyond Traditional Classification to Target Thematic Investments” (March 2021)

| Top Performing MVIS Sector/Thematic Indices | |

|---|---|

| Indices | 1Y Performance |

| BlueStar Electric Vehicles Index | 395.57% |

| BlueStar Solar Energy Industry Index | 351.66% |

| BlueStar Travel and Vacation Index | 188.87% |

| BlueStar Big Data & Analytics Index | 187.10% |

| MVIS Global Gaming Index | 171.01% |

Source: MV Index Solutions GmbH. Data as of 19 March 2021.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

Joy Yang is Global Head of Index Product Management at MV Index Solutions (MVIS). She is responsible for managing MVIS products and services to accelerate innovation in financial index design and adoption. Joy brings more than 25 years of investment experience to MVIS, having led teams delivering index and quantitative-active investment solutions at Arabesque Asset Management, Dimensional Fund Advisors, Vanguard, Aberdeen Standard Investments, AXA Rosenberg and Blackrock. Joy has an MBA from the University of Chicago Booth School of Business, and a BS in Electrical Engineering from Cooper Union’s Albert Nerken School of Engineering.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.