Clearly, we are in extraordinary times. The consequences of a global pandemic juxtaposed with truly unprecedented monetary and fiscal stimuli will be with us for many years to come. Emerging markets have traditionally underperformed in a risky environment, but in general, we believe the behavior of the asset class has not been as bad as many might have predicted. A large part of the negative outcome in the first stages of the pandemic was generated by the abnormal strength of the U.S. dollar, driven by a global “shortage” of dollars. Aggressive central bank action has “normalized” the situation and we continue to have a reasonable hope for U.S. dollar stability (or, dare we say weakness) in the coming quarters. Whilst it may not matter in the shorter term, we think emerging markets currencies are cheap, particularly versus the U.S. dollar.

It is clear that the golden era of globalization has gone and concentrated supply chains will be increasingly questioned. The “business model” of many emerging countries as they progress from low to middle income was predicated on cheap labor and the comparative advantage that this endowed. Either that or as a supplier of significant commodity resources. We believe both “models” will be increasingly challenged in the future and successful emerging markets economies will be based on innovation, education, domestic demand and consumption.

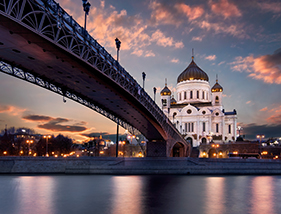

MVIS Russia Index

06/30/19 - 06/30/20

About the Authors:

Ms. Miller joined VanEck in 2019. She serves as Product Manager for VanEck’s Emerging Markets Equity Strategy, where she is responsible for the Strategy messaging, overall positioning and product/market/competitor research. Having worked in the asset management industry for over a decade, Ms. Miller held various positions in global product marketing and new product development (including ESG & Sustainable Investing), new institutional business development and client service. Ms. Miller graduated from New York University with a Master of Public Administration (2012) and Horlivka State Institute, Ukraine, with a Bachelor of Arts (2007). She is also a member of the CFA Institute and CFA Society New York.

Mr. Semple is a veteran of emerging markets investing, with 30 years of experience. From 1996 to 1998, Mr. Semple was a portfolio manager for Asian-focused funds and served on the team sub-advising VanEck’s VIP Emerging Markets Fund at Peregrine Asset Management (Hong Kong). From 1993 to 1996, he served as sales director and regional strategist at Peregrine Brokerage. Prior to 1993, Mr. Semple was a portfolio manager specializing in Asia equity markets at Murray Johnstone (Glasgow). Mr. Semple is a member of the CFA Institute and the Association of Investment Management and Research. He received a Bachelor of Law with Honours from the University of Edinburgh, Scotland. He has had numerous media appearances, including CNBC, Bloomberg, and NPR. Additionally, he has been quoted in the Financial Times, The Wall Street Journal, and Barron’s, among others.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.Get the latest news & insights from MarketVector

Get the newsletterRelated: