Investors look to Emerging Markets as alternative sources of growth and diversification to their core portfolio. But growth and risk are related, you cannot expect growth without bearing risk. As an asset class with greater sensitivity to economic and political risk, Emerging Markets have had a difficult Year-to-Date (YTD). The lingering impact of the pandemic, high inflation, strong dollar, weakening China growth, poorly managed local economic policies are a cocktail for political and economic upheaval. In May 2022, Sri Lanka defaulted on its debt for the first time in its history.

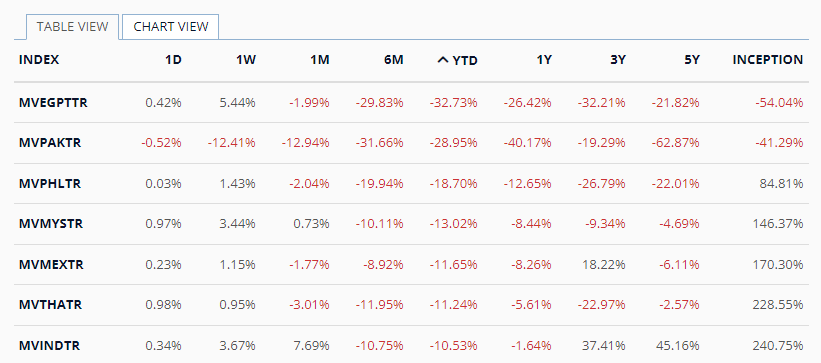

We know from history that Emerging Market crises are contagious, global markets are connected and risk-off trades spread quickly – Sri Lanka will be the first of many crises. But markets are also forward looking, and investors may have already priced in the crisis to come. YTD, using the MarketVector Performance Tool (as of July 25, 2022), we see that most of the Emerging Markets are down with Egypt, Pakistan down greater than the broad global markets at -33% and -29% respectively.

Exhibit 1: YTD Bottom Performers

Source: MarketVector IndexesTM, Performance Tool. Data as of July 25, 2022.

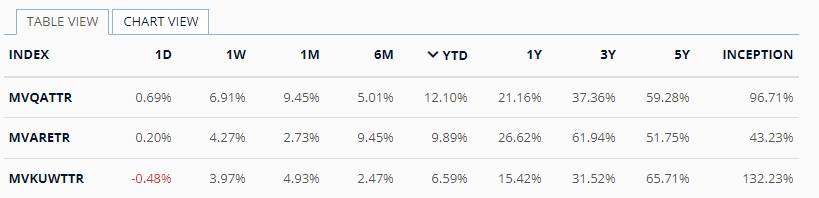

However, Emerging Markets are not a homogeneous collective. With differences in growth drivers and ever-evolving risk dynamics, investing in Emerging Markets requires careful assessment of the individual growth and risk for each country. According to the World Bank (May 2022), countries in the Gulf Cooperation Council (GCC) are projected to expand by 5.9% overall in 2022. With improving fiscal deficits and strengthening energy and exports, these countries are in strong position amongst Emerging Markets. Using the MarketVector Performance Tool (as of July 25, 2022), we see that the top performers across Emerging Markets YTD have been Qatar, UAE, Kuwait returning positive performances of 12%, 10%, 7% respectively.

Exhibit 2: YTD Top Performers

Source: MarketVector IndexesTM, Performance Tool. Data as of July 25, 2022.

MarketVector IndexesTM provides individual Emerging Market country indexes for investors to measure, benchmark and capture the performance and characteristics of individual countries. MarketVectorTM Indexes provide a more accurate reflection of an economy than traditional indexes using a pure-play concept that includes non-local companies incorporated outside the target country which generate at least 50% of their revenues in the target country and excludes local companies within a target country that do not, providing a more complete picture of the sectors and industries that impact the local economy.

For more information on our family of indexes, visit us.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Joy Yang is Global Head of Index Product Management at MarketVector IndexesTM. She is responsible for managing MarketVector IndexesTM products and services to accelerate innovation in financial index design and adoption. Joy brings more than 25 years of investment experience to MarketVector IndexesTM, having led teams delivering index and quantitative-active investment solutions at Arabesque Asset Management, Dimensional Fund Advisors, Vanguard, Aberdeen Standard Investments, AXA Rosenberg, and Blackrock. Joy has an MBA from the University of Chicago Booth School of Business, and a BS in Electrical Engineering from Cooper Union’s Albert Nerken School of Engineering.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. Inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.