With more and more Israeli companies looking to go public, Israel is shifting from the “Start-Up Nation” to the “Scale-Up Nation”.

Often referred to as the “Start-Up Nation,” Israel might’ve found itself a new moniker, as the number of Israeli unicorns that have initiated public offerings continue to grow: the “Scale-Up Nation”

The second quarter of 2021 contained repeated record-setting milestones for Israel’s global capital market, with June capping off a historic Q2 2021 — more than 20 companies completed IPOs on various global exchanges to the tune of more than $37 Billion during the month, alone. Four of those IPOs were done via SPAC-merger, as a total of 6 Israeli companies went public via SPAC during Q2.

What’s perhaps most impressive about these H1 2021 statistics is how much activity there has been on the Tel Aviv Stock Exchange (TASE). In total, 63 Israeli companies had IPOs on the TASE during the first six months of the year — more than 12% of the current total companies on the TASE — which more than doubles the 2020 full year amount, 27, which was the highest at the time since 2007.

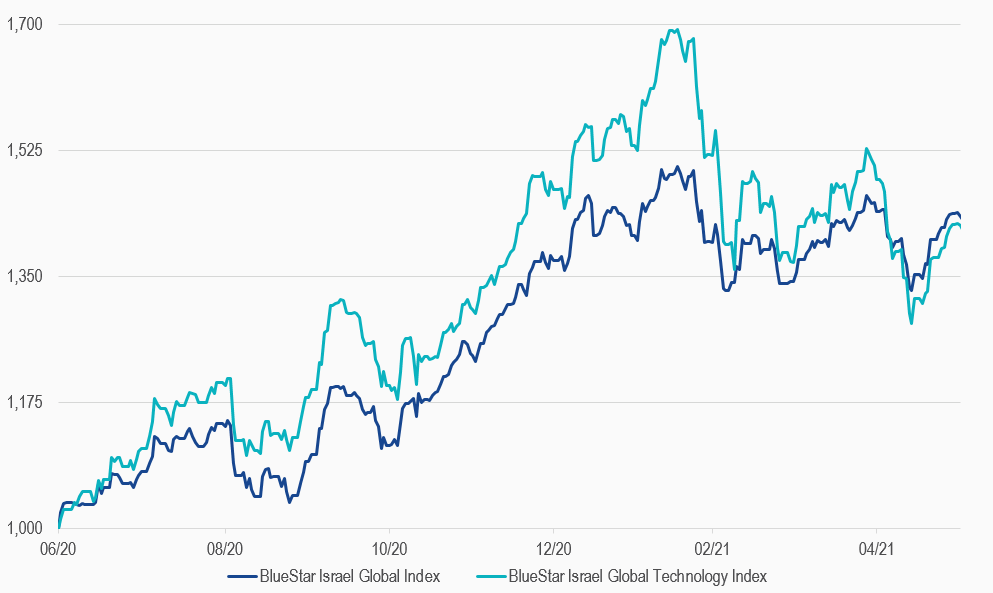

Aside from new IPOs, Israeli equities experienced a rebound after a slow start to 2021. Israeli stocks, as defined by the BlueStar Israel Global Index® (BIGI®), added 8.14% in Q2 2021, outperforming developed international equities by 2.76%, as measured by MSCI EAFE. Israeli technology stocks, as defined by the BlueStar Israel Global Technology Index™ (BIGITech®), returned 7.44% in Q2 2021, trailing the Dow Jones US Tech and S&P Global Tech indexes by 6.45% and 3.06%, respectively. With the IPO pipeline for Israeli companies robust, Israeli equities will continue to generate buzz.

BlueStar Israel Global Index and BlueStar Israel Global Technology Index

30/06/2020-30/06/2021

Source: MV Index Solutions. All values are rebased to 100. Data as of 30 June 2021.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

Steven Braid is a Data and Marketing Analyst at MV Index Solutions. He is responsible for supporting the data, marketing, research, and product services. Prior to working for MVIS, Steven worked as an equity research analyst for Dane Capital Management, a special situations hedge fund, where he focused on SPACs and other forms of special situation transactions. Prior to his time in Finance, he worked as a professional journalist, publishing for the New York Times, USA Today, and other national periodicals. Steven has a M.S. in Data Analytics & Applied Research from the Baruch College Zicklin School of Business, and a BA in International Political Economy from the University of Michigan.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.